This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

Supermarkets page 1

UK Grocery Market Prospects

In this report we look at the UK supermarket sector and its prospects for the rest of 2015. It’s been an interesting year so far, with the big four – Tesco (TSCO), Asda, J Sainsbury (SBRY) and WM Morrison (MRW) – facing continued stiff competition from rampaging German discounters Aldi and Lidl. We’re even seeing attempts at making frozen food cool again begin to bear fruit with the likes of Iceland stepping up to the mark to maintain pressure on the bigger guns.

The UK consumer is much scrutinised as an economic barometer, but never so much as to gauge the health of the general retail sector and this makes the supermarkets some of the less cryptic stocks in the UK 100 . Drivers tend to be much closer to home – think inflation, average earnings, consumer sentiment and interest rates – even if the supermarkets have their fingers in pies much further afield.

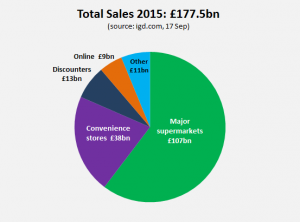

Supermarkets are still the big players

As the above chart shows, despite impressive sales growth in 2015 (Aldi +18%, Lidl +13%), the discounters have a long way to go before they pose a really serious challenge to the UK’s big four supermarket chains in terms of sales value. What they have flagged up, and what the supermarkets missed early on, is a general public that’s become much more cost-conscious and less self-conscious post financial crisis.

Additionally, no longer is Iceland seen as a pusher of sub-standard, cheaply produced frozen goods while a large portion of the Barbour-wearing, dog-walking middle classes have all but jumped into bed with Aldi and Lidl, heaping so much praise on the German discounters it’s not uncommon for cries of ‘get a room!’ to traverse reception rooms at Christmas drinks parties.

What will it take to tempt customers back to the traditional heavyweights? One observation we may make right now is that Tesco (TSCO), J Sainsbury (SBRY) and WM Morrison (MRW) are all facing their own bespoke challenges in addition to battling the common foe in the discounters.

Discounted disruption

As the price war continues to rage with grocery price inflation now at -1.7% year-on-year (otherwise known as deflation) it’s no wonder the growth of the sector at large has suffered. With the relentless rise of competitors with sales growth figures in the mid-teens, it’s clear some form of re-balancing is taking place, and research by Kantar Worldpanel suggests we could be heading for a ‘new normal’ of low yet steady industry growth.

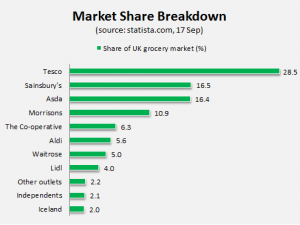

In terms of market share, the discounters unlikely to be really testingTesco, snapping at Sainbury’s heels or marking time with Morrisonsin the near future, but it is interesting to note that Aldi has overtakenWaitrose in terms of market share – a stark reminder of the clout they increasingly carry in the market.

So the questions we must ask of the UK’s (still) leading supermarkets are:

- Which of the big four will adapt quickest to this ‘new normal’?

- Which has the fewest skeletons in the closet?

- Which is ripe for acquisition?

A note on short interest

Both Morrisons and Sainsbury’s currently sit within the six most shorted UK stocks. While this reflects a significant number of bearish bets on the share prices (still far outweighed by bullish bets, nonetheless), what it also means is that any piece of news that is in any way positive could result in those with short positions all rushing for the exit at once since their potential losses are essentially unbounded – a share price can only go down to zero, while it can riseindefinitely. A swathe of buying pressure as traders place buy orders to cover their short positions is highly likely to amplify any positive share price reaction to company news or a good set of results.

« Back to Category

This research is produced by Accendo Markets Limited.

Research produced and disseminated by Accendo Markets is classified as non-independent research,

and is therefore a marketing communication. This investment research has not been prepared in accordance

with legal requirements designed to promote its independence and it is not subject to the prohibition on

dealing ahead of the dissemination of investment research. This research does not constitute a personal

recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published,

and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up,

and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance.

Prepared by Michael van Dulken, Head of Research