The information on this page is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

Trading the financial markets is as much about capital preservation as it is about capital appreciation.

Successful traders will tell you that before placing trades it is paramount to measure both how far you believe a trade can move in your favour as well as how far you would realistically let it go offside before calling it a day, the latter being crucial as a reminder that your money is at stake on every trade.

Only when these two numbers are identified can you calculate what is key in prolonging your trading longevity – the reward-to-risk ratio/multiple which dictates whether trades are worth the risk.

When risking £1,000 you are unlikely to do so for equivalent gains (reward-to-risk ratio of 1:1, or multiple of 1x) – unless it is a dead-cert, of course, but unfortunately the markets offer very few of these, if any.

If you did trade on this basis, and assuming (realistically) that you are not successful on every trade, maybe getting 5 of 10 trades right (50%), a reward-to-risk of 1.0x on each trade would see profits from winning trades offset by losses from losing trades (white boxes in below table). A lot of effort and risk for nothing and no guarantee of you achieving 50% success.

Net trading P&L using reward-to-risk multiple 1.0x

Source: Accendo Markets; trading related costs excluded

In order to get your account balance positive (green shaded section, rising up the blue boxes) using a risk-to-reward multiple of 1.0x on every trade you would need to wither increase the number of winners versus losers (eg. 6 winners vs 4 losers, 7 vs 3, etc; easier said than done) or for profits to exceed losses. Assuming you have little, if any, control over the former, the easiest way to better the situation is to work on the latter by increasing the quality of any potential profits by identifying more attractive reward-to-risk ratios.

Increasing the reward-to-risk multiple of your trades by 50% to 1.5x means that whilst you are still rising

£1,000 on every trade (speak to us about protective tools to limit losses) your potential profits from those

which go according to plan would rise by half to £1,500 per trade.

Net trading P&L using reward-to-risk multiple 1.5x

Source: Accendo Markets; trading related costs excluded

Across a total of 10 trades and with an unchanged 50% success rate, the above table shows how your net gains would rise to a healthier £2,500 – significantly bettering your previous treading of water. Best of all, if your success improved to 60% (6 winners, 4 losers) your profits would rise to £5,000. On the flip side, if your hit rate deteriorated to just 40% the new 1.5x ratio would still allow profits to offset losses. Note also that a 1.5x multiple allows 6 winners to offset 9 of your losers.

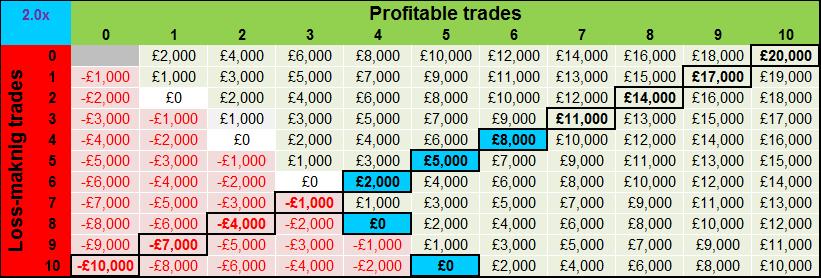

If we assume that to really increase your chances of making a net profit across multiple trades you need to increase the multiple further, to 2.0x for example, the table below shows how 50% success across 10 trades would deliver you net profits of £5,000. It would also allow your success to fall to 4 in 10 and still net you a £2,000 profit whilst rewarding any boost in hit rate to 60% and above with profits exceeding £8,000. Note also that 5 winners would offset up to 10 losses, while 4 would offset 8.

Net trading P&L using reward-to-risk multiple 2x

Source: Accendo Markets; trading related costs excluded

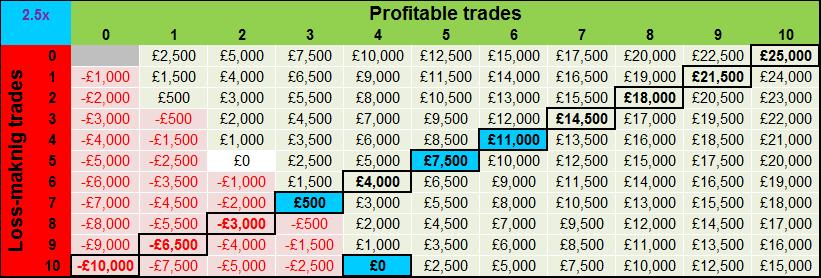

As an analyst producing trade ideas for clients I tend to focus on ratios of 2.5x and above. If I assume that Accendo Markets clients follow a run of my ideas and that I don’t get them all right (I too am realistic – I work hard to identify good ideas but if I did get them all right I would work for myself, from a tropical island), my aim is to have the few hopeful winners offset the likely several losers.

As the table below shows, if you increase your ratio to my preferred minimum level of 2.5x your net profits across 10 trades would rise to £7,500, assuming 50% success. If we are pessimistic and assume as low as 30% success (just 3 out of 10 trades right) you would still bank a £500 profit – not great, but still better than breaking even after all that work and a helpful contribution to covering trading costs.

Net trading P&L using reward-to-risk multiple 2.5x

Source: Accendo Markets; trading related costs excluded

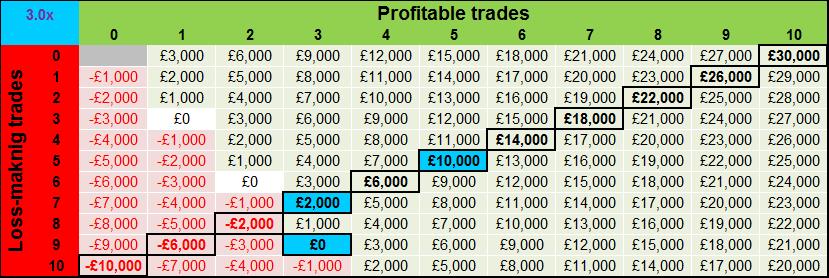

If your success improved to 60% profits would rise to an impressive £11,000, which could be used to covering another 11 losses if you had a bad run, and extremely significant is that just 4 winners would be able to offset up to 10 losers. Once we get into the realms of risk-to-reward multiples of 3x and above profits across 10 trades with 50% success rise to£10,000 and just 3 winners suffice to numb the pain from 9 losers. Anything better and profits increase significantly, while success can drop as low as 30% and still generate £2,000 profit.

Net trading P&L using reward-to-risk multiple 3x

Source: Accendo Markets; trading related costs excluded

But that’s so obvious

Many will claim that what we have looked at is very obvious, but it is extremely common to see even seasoned traders repeatedly making the same mistakes;

a) Risking too much on a few trades (all their eggs; no diversification);

b) Assuming success rates will be higher (natural optimism), and;

c) Focusing too much on what can be made as opposed to what is being risked (see above).

The result of the above is from where the adage “a long-term trade is just a short-term trade gone wrong” is derived, with traders refusing to take a loss.

Whilst I agree that trades can always come good it is a very one sided argument which ignores the fact that things also can always get worse. Once offside, a trade has to do a lot of work just to recover to breakeven, never mind make a profit as was originally forecast.

Avoiding closing out of a trade at your pre-defined worst-case level goes against your trading strategy and setup. What changed your mind? It was your worst case scenario and now it’s worse. Keeping it open and hoping it recovers also deprives you of the chance to preserve capital and more importantly put it to work in a better trade idea.

Think before you trade

Next time you’re about to place a trade identify your worst and best-case price scenarios. Make sure you’re realistic with both, remembering that you’re risking real money. Now take the multiple of profits versus losses and decide whether the aggregate profit across 10 trades (assuming a realistic success rate) using a similar setup would be worth the work involved in placing and monitoring.

The higher the multiple you use, the more green there will be on the P&L tables tables and thus the more chance of making a net profit across the trades and the fewer winners you will need to offset the several losses. As a reminder, the lower the multiple you use the lower the profits potential from any winners and less proifts there will be to offset the inevitable losses.

Trading less but more wisely, spending more time more time identifying better setups is a solid recipe for a long and ultimately profitable trading lifetime.

I hope that what you have read is a breath of fresh air, makes you think the next time you trade and ultimately helps you in your pursuit of long-term and profitable trading. This is just one of many educational pieces which we provide to trading clients, and we hope you will join us soon.

Mike van Dulken, Head of Research