The information on this page is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

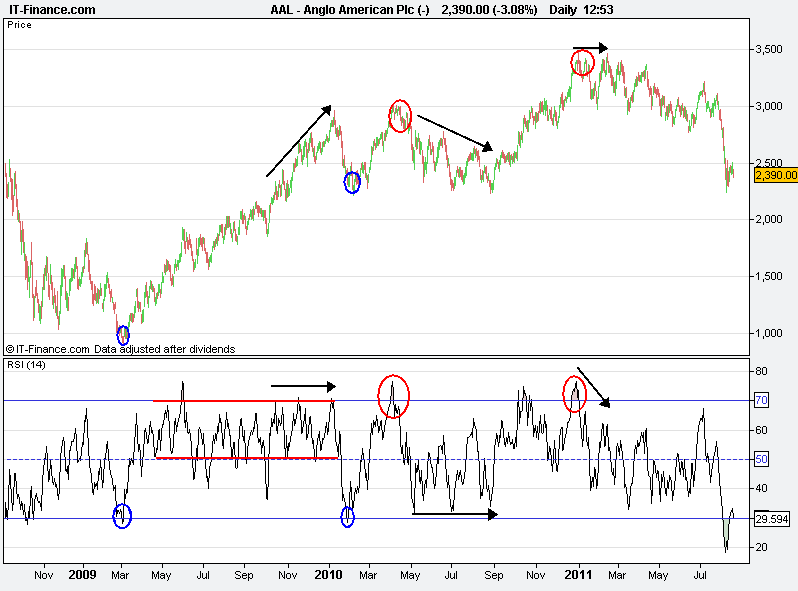

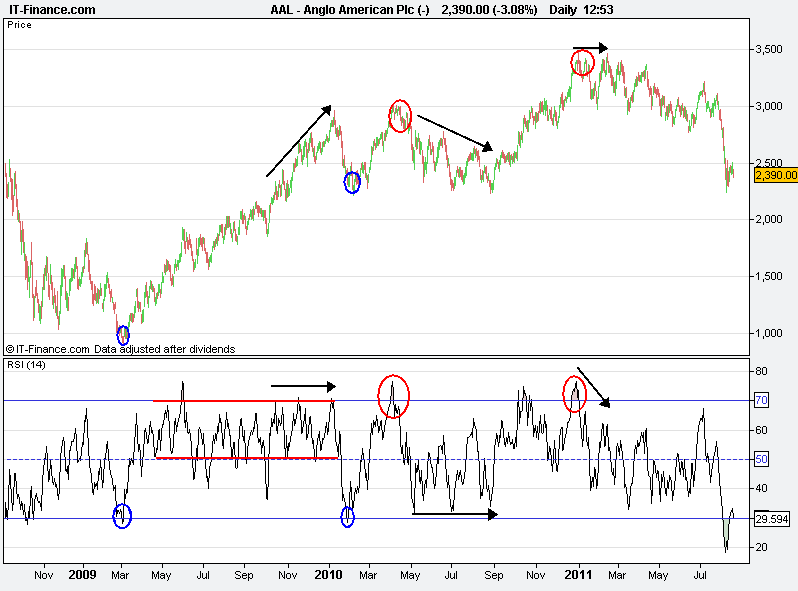

The RSI is a useful indicator, which provides ‘overbought’ and ‘oversold’ signals. See the lower chart on the image below – a move above 70 tells us that an asset may be overbought (and therefore provides a sell signal), a move below 30 tells us that an asset may be oversold (and therefore provides a buy signal).

Introduction

Relative Strength Index (RSI) is another momentum indicator, measuring speed and magnitude of directional price movements, by looking at the ratio of higher closes versus lower closes. Shares with more, or stronger, positive changes have a higher RSI value than those with more or stronger negative changes. The indicator charts the current and past strength or weakness of a security compared to itself and should not be confused with Relative Strength, indicating the strength of one security versus another (i.e. Vodafone vs UK 100 ), nor with the different momentum indicator.

Explained

RSI is normally calculated using a 14-day period, although most charting packages allow this to be customised depending on one’s trading horizon. The indicator works over a 0-100 scale, with overbought and oversold levels at 70 and 30 respectively. Values above 70 and below 30 suggest stronger up/down momentum. For each trading period, an upward/downward change is calculated by subtracting the previous close from the current close for an upmove or the current from the previous for a down move. The 14-day EMA/exponential moving average is then calculated for each, and the result for upward moves divided by the result for down moves to derive the final RSI figure. When prices move up/down quickly, at some point they are considered overbought/oversold and a reversal may occur. The level of the RSI highlights the security’s recent strength in trading. Its angle of ascent/descent is directly proportional to the velocity of a change in the trend. The higher/lower it goes, the greater the magnitude of the price move. Shares can remain overbought/oversold for considerable periods once a trend is in place. Uptrends tend to remain between 40-80, while downtrends normally stay in between 20-60. One should thus wait for the RSI to cross back down/up through 70/30 for confirmation that a correction may be beginning (see caveat below). Another way of using the RSI for warning signs of a reversal are via divergence. When RSI is flattening out after an up move, and begins to turn down, but the shares are still rising, we can assume that the shares will soon begin to lose steam, their advance slow, the shares top out and eventually turn down, mirroring the RSI. This is an example of negative divergence. If the RSI turns up before the shares bottom out, this is positive divergence.

Examples

1. Black arrows indicate divergence between RSI and price potentially signalling a change in trend.

2. Overbought (>70) and oversold (<30) zones indicated with blue lines on lower chart

3. Circles indicate moves down from overbought or up from oversold.

4. Red parallel lines indicate RSI stuck in upper half (40-80), thanks to up-changes in price outweighing down-changes. This happens when price trend is strong.

Conclusion

RSI is one of many key indicators in technical analysis, its use helpful in the trade selection process. While some price patterns may appear to say one thing, with volume agreeing, a cursory glance at RSI may indicate that a short-term trend is losing steam. See page 2 for an example of RSI and divergence. As always, only when the share price itself confirms (break of trendline/cross of a moving average, etc) should a trade decision be made.

Caveat

Technical indicators should never be relied upon in isolation for trading decisions, however strong a signal may be. Ultimately they are one of many indicators, which may, in the majority, be pointing the other way. Always use indicators such as moving averages in combination with other indicators (trendlines, price, price patterns, support/resistance, oscillators, etc) to assist in the final trading decision. Lastly, the current trend of a share should always be respected – pre-empting a change in trend more often than not proves costly.