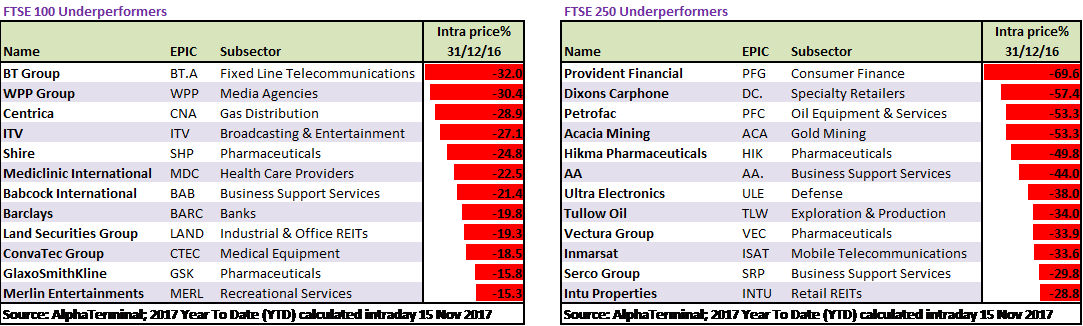

The tables below show the 12 worst performers from both the UK 100 and .

This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

The tables below show the 12 worst performers from both the UK 100 and .

The first, and perhaps easiest observation to make, is that 10 of the 12 underperformers have fallen by more than the biggest UK 100 underperformer. Why would this be?

The smaller market capitalisation of the stocks makes them more susceptible to big swings in share prices, with lower daily trading volumes also contributing to the greater volatility in these stocks. With that said, as mentioned earlier the two top underperformers were both UK 100 stocks earlier in 2017, while Hikma Pharmaceuticals and Intu Properties were both components of the blue-chip index at the start of the year.

Interestingly, a number of these stocks hail from similar sectors. Petrofac, Acacia Mining and Tullow Oil are all commodity producers, although they have under-performed for different reasons. Acacia faced an export ban in its key market, Petrofac was subject to an investigation into corruption and Tullow underwent a rights issue.

When looking at the UK 100 , it’s interesting to note the plethora of very large-cap stocks making up the list. Companies such as BT and WPP have market caps of several billion pounds Sterling and have been constituents of the UK 100 for decades. Furthermore, it’s interesting to note WPP traded an all-time high early in 2017 before the company’s share price fall 7.9% during a single session in March after a profits warning. However, BT maintains the fifth largest dividend yield on the index at 6%, while Centrica has the second largest at 7.25%.

Whilst commodity producers underperformed on the , the sector that has clearly underperformed on the blue-chip index is the Pharmaceutical sector. Shire is the notable underperformer, struggling to overcome concerns that its product pipeline is not as promising as it once was, while GlaxoSmithKline has faced a similar issue. UK Index newcomers Mediclinic International and ConvaTec both hail from the Medical sector, and have both suffered as results disappointed investors, despite the former rallying 17.5% during a single session in April.

Finally, it’s also worth noting that UK 100 are not immune to issuing profits and sales warnings, with ITV and Merlin Entertainments both having issued the latter kind.

From the preceding 24 stocks, we’ve chosen our five favourites to analyse further. On the following pages, we delve deeper into the technical signals each are exhibiting, as well as providing a breakdown of the broker recommendations currently available. Which stocks could see a 2018 recovery and which have further to fall?

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance. Prepared by Michael van Dulken, Head of Research

Comments are closed.