This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

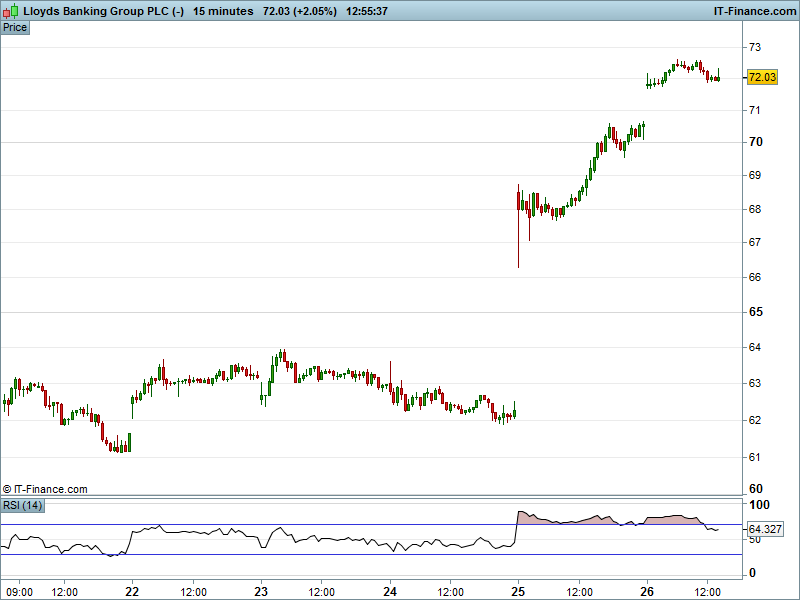

What a great week for trading! Not only did we witness the UK 100 managing to hold up around the ceiling of its 3-month falling channel (opening up the possibility of a bullish breakout into next week), but the UK banks also brought some amazing trading opportunities to the table. First of all, Lloyds Banking Group (LLOY) gave markets a little sweetener on Thursday in the form of a tiny special dividend, which resulted in a not-so-tiny share price rally (circa 15% on the day, with shares continuing to outperform on Friday).

On the other hand, Royal Bank of Scotland (RBS) management will be kicking itself for doubling the pay packet of CEO Ross McEwan instead of saving upfor a sweetener of its own! Shares in the other of the bailed out uk banks are down 8% on Friday (see chart below). These are big moves that investors didn’t need a lot of complex analysis to foresee.

Suspicions may well have been aroused on two occasions this week. First, with expectations for the UK banks’ 2015 earnings universally low, pre-results speculation about LLOY announcing a special dividend could have coupled with shares trading just above 3-year lows to give a fair idea of what may have been in store. And if you missed that, then the sight of RBS shares following LLOY north on Thursday (in highly speculative fashion) might have garnered your attention, despite the conspicuous absence of dividend chat from RBS. Easily said by someone with the charts in front of them all day, you say? Well, yeah, but read on!

Of course there’s no shame in having missed cues such as these – if this is the first you’ve heard, then you’re one of the many. At Accendo Markets, our mission is to make you one of the few. Will the UK 100 break out to the upside next week? Will the UK banks continue to trend (up in the case of LLOY, down in the case of RBS), or will they reverse course? Sign up today to get regular analysis, research and trade ideas direct from our analysts. With Accendo, you’ll be first to know, whatever happens.

Have a great weekend!

Tom Robertson, Senior Trader, 26 Feb

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance. Prepared by Michael van Dulken, Head of Research

Comments are closed.