This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

The Tuesday before the first Friday, of the last month of the quarter. That’s the week after next. But why is it so important?

The Tuesday before the first Friday, of the last month of the quarter. That’s the week after next. But why is it so important?

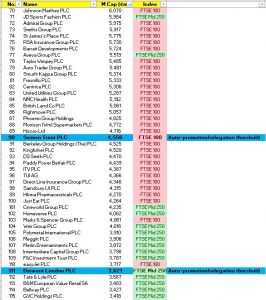

It’s the 4th of June – the cut-off for determining who will be promoted to and demoted from both the (mid-cap index) and UK 100 (bluechips) indices on 24 June. The UK Index quarterly review, or reshuffle. So who’s in-line for a move up or down?

First up for promotion are JD Sports Fashion and Aveva (industrial engineering/software), in 71st and 77th position by market capitalisation on the (the UK 100 and 250 combined). This is comfortably above the 90th place threshold for auto-promotion thanks to gains of 76% and 42% year-to-date, respectively.

Interestingly, there is nobody in-line for auto-demotion, however, easyJet (#110) is flirting with the 111th place threshold.

But as an index of 100 names, the two auto-promotions to the UK 100 requires two demotions. As it stands, easyJet, Marks & Spencer (#103), Just Eat (#100), Hikma (generic drugs; #99), Sainsbury (#98), Direct Line (insurance; #97), TUI (travel; #96) and ITV (#95) are in the firing line.

But as an index of 100 names, the two auto-promotions to the UK 100 requires two demotions. As it stands, easyJet, Marks & Spencer (#103), Just Eat (#100), Hikma (generic drugs; #99), Sainsbury (#98), Direct Line (insurance; #97), TUI (travel; #96) and ITV (#95) are in the firing line.

To avoid, demotion, easyJet would need to rally 14%, and M&S by 5%. Then we’d be discussing some of the other above names. But nearly all are household names. Some investors may end up surprised that their UK 100 investment is now a holding.

To miss out on promotion, JD Sports would need to fall by a rather significant 24%, and Aveva by 17%. Unlikely, but the compliance-friendly devil’s advocate in me must highlight JD sports was scheduled to publish results today. Should they be delayed or really disappoint. Well you know what could happen. Same applies to Aveva which reports next Wednesday (29th).

That’s it for the big boys. At the tail end of the , likely contenders for a promotion from the UK Index Small caps include 4imprint and Paypoint, both 4-5% above the #325 threshold for auto-promotion. It is likely these will be balanced by demotions from the of Indivior and Stobart, both of which sit 26% and 33%, respectively, below the threshold.

It’s not a given, but these names could see increased share price volatility next week. I mean that in a good way, in terms of more activity, offering more trading opportunities. Because UK 100 index trackers may want/need to own a certain sports fashion chain and industrial software engineer to replicate the index. Likewise, they may need to dump a certain Airline and a well-known Retailer. And there will be media attention around those names, which may in turn fuel additional interest.

Nothing’s in stone. The numbers could all be different by this time next week. But you have to take a snapshot and make a decision some time. Now’s a good time to know who’s in-line to be able to act next week. Where do you think those names will finish? Do you own any of them? Do you want to?

Nothing’s in stone. The numbers could all be different by this time next week. But you have to take a snapshot and make a decision some time. Now’s a good time to know who’s in-line to be able to act next week. Where do you think those names will finish? Do you own any of them? Do you want to?

Whatever you trade, and however you trade it, get access to our research Gold Pass. That we we can provide you with daily actionable trade ideas including Ranges, Breakouts, Bounces and much more. As well as helping keep you up to date with things like the UK Index quarterly reshuffle.

Enjoy your long weekend.

Mike van Dulken, Head of Research, 24 May 2019

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance.

Prepared by Michael van Dulken, Head of ResearchComments are closed.