This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

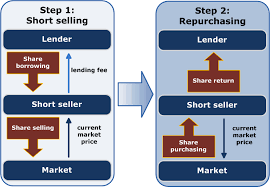

Just 3 short weeks ago I delivered a gentle reminder that CFDs offer the opportunity to profit from falling prices. Now I also correctly forecast that, by discussing said topic, the December declines might come to an end. And the UK Index did indeed rally until end-Dec, so it’ll probably bounce now – just watch!. However, the tough start to 2016 compels me to revisit Shorting (see here) in this first roundup of the new year. This is due to the possibility that it proves as turbulent as 2015 and that the current 8-month downtrend persists. This is not a forecast, rather a reminder that markets go down as well as up and that you aren’t restricted to calling the bottom or waiting on the side-lines for prices to improve. If you believe that the price of share, index, commodity or currency might fall why not trade it with a short position? If you already have a long position why not consider closing it and going short, or at least hedging it so you can sleep easy at night knowing your losses are offset. It’s natural to want to correctly call rising prices. But there is nothing different in calling a falling price correctly. They both deliver the same key result – profits, which is what you are trading for.

My colleague has mentioned the diversification of the UK Index being a little appreciated factor last year that prevented its 5% declines from being a lot heavier. If you’re not prepared to consider shorting at least diversify to include some from the lesser known names that could deliver gains again this year but have been little discussed in the media. It could be that the UK Index rallies 20% this year. It could be that it falls 20%. The depressed Oil and Mining sectors could rebound strongly; the Housebuilders could collapse. Whatever happens, we owe it to you as clients to highlight all the options available while you owe it to your account balance to make sure you consider all those options. Whether you are new to the markets or a seasoned veteran, everybody knows share prices go down as well as up. Don’t get stuck on one side of the action when times are tough. As much money can be made on either side of the order book. In some cases more can be made quickly from shorting with their more likelihood of panic selling than panic buying. Now we’ve talked about this twice in a month, there’s no excuse for getting caught out next time.

Mike van Dulken, Head of Research

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance. Prepared by Michael van Dulken, Head of Research

Comments are closed.