This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

What good is owning a home in the UK if you don’t go through the daily anxiety of real estate value crashing due to Brexit? Well, it’s not like you can afford to worry about owning or buying a house if you’re a millennial. But for everyone else, the new 31st of October withdrawal extension could be a sigh of relief this summer.

What good is owning a home in the UK if you don’t go through the daily anxiety of real estate value crashing due to Brexit? Well, it’s not like you can afford to worry about owning or buying a house if you’re a millennial. But for everyone else, the new 31st of October withdrawal extension could be a sigh of relief this summer.

When the dreaded exit day will finally come, it is anybody’s guess as to where house prices will head. By reading the news,one might think that the housing market could only crash or go into an unprecedented bull market. So what are the arguments for both scenarios?

A generally weakened post-Brexit British economy due to instability, and investors and companies heading to greener pastures could mean that the average Brit will have less money and higher costs. In this case, demand for houses might fall and UK Index house builders like Bellway (-9% since April highs) or Redrow (-18.5% since March highs) could see their business take a hit. The past six months have already been characterised by low buyer interest, slowest house price growth for six years and falling property prices in London.

However, Brexit could represent a very good opportunity for the intelligent house-buyer. There is a paradox to take into consideration: More people and companies leaving a Brexit fatigued Britain, causing house prices to drop due to lack of demand. This would cause foreign investors to buy up prime real-estate in London, still arguably the financial capital of the world.

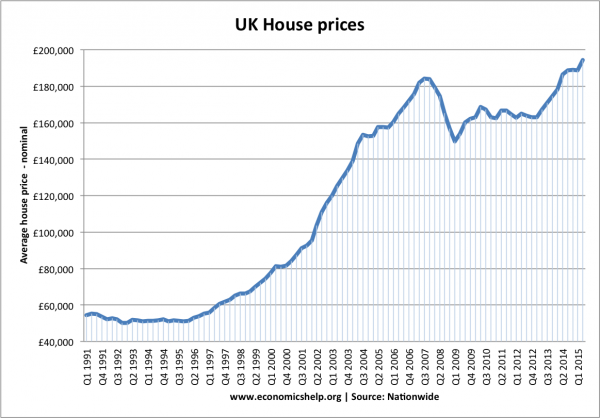

Either way, the withdrawal isn’t due until Halloween at the latest. Home buyers who have postponed moving into a new place because of the uncertainty of a post 29 March UK real estate landscape see a six month window of relative stability to finally move in. All the while, house prices keep making all time highs.

This rush could cause the overall housing market to go into a bull market during the summer before the final UK exit date. Add to that the fact that summer is the best season for new accommodations being built and a recipe for growth could be well on the horizon. Other house builders are fairing quite well with this apparent surge of demand for houses. The likes of Barrat Developments and Berkeley Group are up by 5.4% and 4.3% respectively since early May.

Are you interested in the housing market? Are you investing? Are you a 20-something trying to make some extra cash to move out? Then let us keep you up to date with all the moves and shakes of the housing markets with our Research Gold Pass. Let us build the foundation so you can enjoy your trading even more.

Avin Nirula, Senior Trader, 17 May 2019

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance.

Prepared by Michael van Dulken, Head of ResearchComments are closed.

Accendo Markets is an award-winning provider of CFD and spread betting trading services. We provide an execution-only service.

Telephone calls and online chat conversations may be monitored and recorded for regulatory and training purposes.

* We provide these as underlying assets to CFDs and Spreadbets.

To view our policies and terms, please click here

This website is not intended for or directed at residents of the United States or any country outside the UK. It is not intended for use by or distribution to any person in any jurisdiction or country where its use or distribution would contravene any regulation or local law.

Prices on this page are delayed.

Like many websites, we use cookies for statistical purposes and to acquire information on general internet use. This helps ensure that you get the full benefit of our services, and enhances your browsing experience . For more details on the cookies we use, view our privacy policy under the heading 'How We Use Cookies'. By using this website, we'll assume that you're happy to receive all cookies from Accendo Markets.

Removing cookies may impede the operation of some parts of this website. For general information about cookies and how to remove them, please click here