This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

I’m glad to say that last week’s “results lingo” explainer went down a treat, helping clients better interpret this week’s deluge of share price moving company updates. But the latter still gave rise to the usual confusion about how on earth a share price could possibly fall, even after the company posted higher sales and profits.

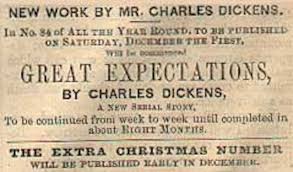

Almost certainly because the results failed to live up to expectations. Whose? Investors and analysts. Revenues or Sales may well have grown to record levels. Profits too. But if they weren’t as high or didn’t grow as fast as the market was expecting, then the results will have disappointed.

Almost certainly because the results failed to live up to expectations. Whose? Investors and analysts. Revenues or Sales may well have grown to record levels. Profits too. But if they weren’t as high or didn’t grow as fast as the market was expecting, then the results will have disappointed.

In fact, profits are even more important than Sales because if they aren’t growing as fast then costs must be rising more quickly. Which means lower productivity, lower margins, lower profitability. More sales, more effort, lower returns. Not a good trend. So why would the shares rise?

But that’s all in the past, literally. And what’s even more important for the share price is the future. If I’ve said it once, I’ve said it a thousand times. You can’t buy past growth, you can only buy into the prospects of future growth in profits, dividends and, of course, the share price. If the prospects for the former aren’t as good as expected, then the prospects for the latter aren’t as rosy. And the same as above will apply – investors will be disappointed and the share price will probably fall.

If a company’s full year guidance was for sales to grow 5% and profits by 10%, but management subsequently revises this to 3% and 7%, then the guidance is now worse. Otherwise known as a profits warning. The outlook is now not as bright. So why  would traders like this?

would traders like this?

In fact, even if management increased the sales growth forecast (from 5% to 7%), but trimmed the profit growth forecast (from 10% to 6%), it would still be classed as a profits warning. Because management is now forecasting slower profits growth, even though it is expecting sales to grow more quickly. Remember what we discussed above? Sales growing faster, profits not keeping up; lower productivity, lower margins, lower profitability. Outlook not as good as before. Why would the shares be up?

Which brings me to a very wise City adage: “Sales is vanity, Profits is sanity, Cash Flow is reality”. Sales don’t matter if you’re not turning a profit. Profits doesn’t matter if you’re not generating cash. Because without cash you can’t invest in the future to grow the business and, more importantly, pay shareholders dividends. Which are, after all, their reward for risking money in the shares. Hence why guidance on cash flow can often trump that of sales/profits.

Which brings me to a very wise City adage: “Sales is vanity, Profits is sanity, Cash Flow is reality”. Sales don’t matter if you’re not turning a profit. Profits doesn’t matter if you’re not generating cash. Because without cash you can’t invest in the future to grow the business and, more importantly, pay shareholders dividends. Which are, after all, their reward for risking money in the shares. Hence why guidance on cash flow can often trump that of sales/profits.

As another exciting earnings season begins to quieten down I’d like to draw your attention to two very good examples of rather opposing but very relevant results-day reactions, both yesterday.

If you want to learn even more about interpreting company results get access to our award-winning research. As of next week, in your email inbox, you’ll find a selection of helpful publications telling you what’s going on the in financial markets (especially company results!), highlighting key trading levels on the UK 100 and the shares of its well-companies (Banks, Miners, Oil, etc), hand-picked well structured trade ideas and, of course, invaluable insight like you’ve sampled above.

As always, enjoy our weekend.

Mike van Dulken, Head of Research, 11 May 2018

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance. Prepared by Michael van Dulken, Head of Research

Comments are closed.