This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

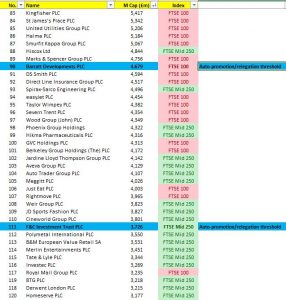

Building on what my colleague wrote yesterday about Tuesday’s upcoming UK Index review (a.k.a the Quarterly Reshuffle), I thought I’d look at all the shares in contention for a move up or down on Christmas Eve. This includes changes between the UK 100 blue-chip index (think Premier League of football) and the mid-caps (think Championship). It also includes moves between the mid-cap index and the Small-Caps list (think League 1, where Bournemouth were as recently as 2013, before two title promotions in three years allowed them to enjoy four seasons as a blue-chip).

Why look lower too? Because some of the names further down the list trade decent volume (up to £6m/day). More importantly, they can offer more very attractive volatility which can be of great interest to trading clients. Furthermore, while top flight changes garner most media attention they tend to be limited (one or two; sometimes none like in September). Further down the pecking order, however, we can get a raft of reshuffle changes up and down which could add festive spice to year-end trading.

Why look lower too? Because some of the names further down the list trade decent volume (up to £6m/day). More importantly, they can offer more very attractive volatility which can be of great interest to trading clients. Furthermore, while top flight changes garner most media attention they tend to be limited (one or two; sometimes none like in September). Further down the pecking order, however, we can get a raft of reshuffle changes up and down which could add festive spice to year-end trading.

First up is insurer Hiscox, up another two places from yesterday, now ranked #88 on the UK Index All Share list, putting it in auto-promotion territory (ranked higher than #90) for a jump up from mid-cap status to blue-chip. This could benefit the shares as index trackers are forced to include them in their portfolios. Royal Mail, has risen one places, but remains in the relegation zone, now ranked #117 versus the #111 threshold for survival. It could suffer from similarly inspired selling pressure ahead of the the Christmas-eve application of next week’s reshuffle.

My colleague discussed these names as they looked guaranteed to make next Tuesday’s cut-off. I will add to this engineer Spirax-Sarco which is very close to auto promotion, ranked #93, but still needs to leapfrog whoever is ranked #90 (currently house-builder Barratt Developments, 4.1% above). Next best candidates for promotion are generic drug maker Hikma and insurer Phoenix at #98 and #99, both requiring more considerable 8.3% share price increases by next Tuesday’s close. A tall order, but not impossible.

My colleague discussed these names as they looked guaranteed to make next Tuesday’s cut-off. I will add to this engineer Spirax-Sarco which is very close to auto promotion, ranked #93, but still needs to leapfrog whoever is ranked #90 (currently house-builder Barratt Developments, 4.1% above). Next best candidates for promotion are generic drug maker Hikma and insurer Phoenix at #98 and #99, both requiring more considerable 8.3% share price increases by next Tuesday’s close. A tall order, but not impossible.

On the flipside only Royal Mail is firmly in auto-relegation territory, 13.2% into the dropzone. Therefore one of the above trio of Spirax, Hikma or Phoenix needs to move above #90 in the rankings to force another UK 100 member (the next lowest ranked) down. As it stands, these are online estate agent Rightmove and take-away delivery JustEat, ranked #107 and #106.

If these last two are to be relegated of their own accord, however, (in turn auto-promoting the next highest ranking constituent; Spirax, Hikma or Phoenix), the online estate agent and takeaway delivery name would still need to fall to take the place of whoever’s ranked #111: currently F&C Investment Trust, 6-7% below.

That’s it for the top flight. So what about further down the list? While all above action took place between #90 (market cap £4.7bn) and #110 (market cap £3.7bn) on the UK Index All Share rankings, we have to descend to #325 for Small Cap promotion to the (market cap £710m) and #376 (market cap £518m) for relegation to Small Cap.

Who is knocking about down there? As it stands, gold miner Acacia Mining (#314), retirement house-builder McCarthy & Stone (#319) and investment trust Woodford Patient Capital (#321), all in-line for auto-promotion, while Sabre Insurance (#325) is right on the cusp. Brewer Marstons (#332) would need a 4.9% rally to cement promotion.

At the other end it could be bad news for private healthcare group Spire (#383) and troubled travel company Thomas Cook (#391) without 2.3% and 5.8% share price rallies, respectively, before Tuesday’s close. As for engineer Keller (#410) and Civitas Social Housing (#446), both look too far gone, destined for the drop.

At the other end it could be bad news for private healthcare group Spire (#383) and troubled travel company Thomas Cook (#391) without 2.3% and 5.8% share price rallies, respectively, before Tuesday’s close. As for engineer Keller (#410) and Civitas Social Housing (#446), both look too far gone, destined for the drop.

And there you have it. It’s not static, share prices move and we still have the rest of today and two full trading sessions next week before Tuesday’s reshuffle cut-off. The start of a December Santa Rally could also change things next week. But at least you know the names to look out for.

Who’ll get that early present of a Christmas Eve promotion and who’ll get that lump of relegation coal? To see if any of them feature among our hand-picked trading opportunities next week get access get access to our trade opportunities here.

Mike van Dulken, Head of Research, 30 Dec 2018

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance.

Prepared by Michael van Dulken, Head of ResearchComments are closed.