This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

Energy shares have been battered by the recent oil price fall. Brent Crude has dropped close to 30% from October’s 4-year highs. Not all shares, however, have been under pressure to the same extent.

Energy shares have been battered by the recent oil price fall. Brent Crude has dropped close to 30% from October’s 4-year highs. Not all shares, however, have been under pressure to the same extent.

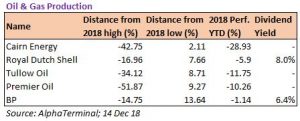

Naturally, commodity prices have a strong impact on oil & gas stocks. With oil -9% this year, all London energy companies are thus down for 2018. At the same time, performance has been uneven across the sector. Why? Inidividual share prices move based on each company’s story, rather than global events, like energy supply & demand, geopolitical sanctions or disruptions.

What is obvious is that the big oil majors (BP and Shell) have outperformed the mid-cap explorers/producers by a significant margin. While all are down for the year, Shell and BP are down the least (-5.9% and -1.1%, respectively). This compares to an average -11.7% for the oil production/services sector as a whole.

Shares in Cairn Energy – focused on exploration in the UK, Norway and West Africa – are down 29% year-to-date after performance of its North Sea offshore fields disappointed leading to a H1 pre-tax loss. BP, by comparison, more than doubled Q3 profits, with Shell doing similar, with profits +83%.

Shares in Cairn Energy – focused on exploration in the UK, Norway and West Africa – are down 29% year-to-date after performance of its North Sea offshore fields disappointed leading to a H1 pre-tax loss. BP, by comparison, more than doubled Q3 profits, with Shell doing similar, with profits +83%.

Yes, BP and Shell are huge multinational, global companies. They don’t just drill for oil (upstream), they also sell refined oil products (downstream). The smaller companies, however, typically only operate upstream. Yet this is not the reason for the majors’ outperformance.

BP Q3 upstream profits grew 156% YoY, while Shell’s jumped 239%. Downstream earnings, however, fell 9.7% at BP and 29.2% at Shell. Compare that with smaller peer Premier Oil, which swung to a $24.7m H1 pre-tax loss, despite enjoying the same rising oil prices through early October.

Another thing helping the majors has been their significant cash flows. This allows them to reinvest in the business and return cash to shareholders. As dividends or via share buybacks. Both can support demand for shares. The smaller explorer/producers, like Cairn, Tullow and Premier don’t benefit from this. Because they don’t pay dividends. Cairn never has, while Tullow and Premier Oil suspended payments several years ago, following a drop in oil prices.

Another thing helping the majors has been their significant cash flows. This allows them to reinvest in the business and return cash to shareholders. As dividends or via share buybacks. Both can support demand for shares. The smaller explorer/producers, like Cairn, Tullow and Premier don’t benefit from this. Because they don’t pay dividends. Cairn never has, while Tullow and Premier Oil suspended payments several years ago, following a drop in oil prices.

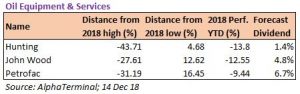

Oil support/services companies are more attractive than the mid-cap producers because they do pay dividends (see above), in some cases as much as the majors, which pay 6-8%. The majors can also splurge in other ways: BP spent $61.7 BILLION (sic!) on share buybacks since 2000 (Source: The Telegraph) and Shell started a 2-year $25bn buyback programme this summer. Share buybacks represent a “forced buyer” and tend to support the share price.

You might be used to hearing punchy headlines in the press about Iran sanctions, falling oil prices and weak global crude demand. You might think this makes UK Index Energy shares “un-investable” – better off putting your money elsewhere. The real picture, however, is more nuanced. Not all oil companies are the same. The big boys are weathering the oil market downtrend much better than smaller peers. The question now, which of the 3 subsectors discussed will outperform?

Whether you like Banks, Housebuilders, Miners or Energy, it pays to understand the sector you are investing in. That way, you can make informed decisions about which names fit your financial portfolio the best based on your risk appetite and sector outlook.

If you want professional support in researching your favourite stocks, placing trades or understanding the markets, Accendo Markets is here to help. Become a part of our growing trading community by clicking here to receive our daily trading opportunities straight into your inbox.

Amrit Panesar, Trader, 14 Dec 2018

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance.

Prepared by Michael van Dulken, Head of ResearchComments are closed.