This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

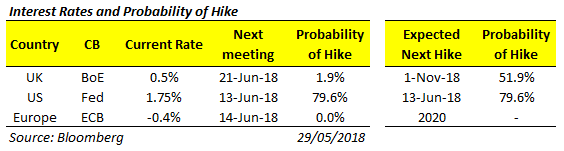

The strongest factors influencing the direction and momentum of Foreign Exchange (FX) rates are changes in the key interest rates, themselves highly sensitive to macroeconomic data such as inflation and economic growth. Higher interest rates tend to render the currency more attractive (and vice versa) which in turn can result in it strengthening versus other currencies.

In the UK, interest rate policy is determined by the Bank of England’s (BoE) Monetary Policy Committee (MPC), which meets several times a year and whose decisions are closely watched by all FX traders, especially those trading Pound Sterling (GBP).

In the US, key interest rate decision-making body is the Fed’s Federal Open Market Committee (FOMC), influencing the US Dollar (USD), while for the single currency Euro (EUR) in the Eurozone, it is the European Central Bank (ECB).

The following events this week could have a major impact on FX markets.

GBP

Brexit negotiations will remain critically important to the state of GBP in the coming days. With the talks becoming heated the previous week, all eyes will be on PM Theresa May to see how she will manage to juggle both Brexit hardliners in her own cabinet and unyielding EU negotiators in Brussels.

With UK government admitting that the “no-deal” hard Brexit scenario contingency planning not even close to being complete, PM could be forced to either call for snap elections to resolve the cabinet split (which will hit GBP hard), or seek an unpalatable compromise in Brussels. Markets will be looking for clarity on the customs union and Irish border before giving any support to the Pound.

Fractures within UK government spread on to the Bank of England, with reports (source: FT) that the BoE and the Treasury are at an impasse over the Bank’s post-Brexit regulatory powers over the City. With potential for the BoE’s rule setting powers to diminish on the horizon, GBP could be further battered, if policy disagreements are not smoothed out.

This week will see few macroeconomic data releases with potential impact on the Pound, with consumer confidence, net consumer credit (Thurs, May 31) and Manufacturing PMI (Fri, 1 June) having the most impact. Most analysts expect lending and mortgages to have growth in April, while the more important Manufacturing PMI data is expected to fall, putting further pressure on GBP.

EUR

Fallout from the continuing Italian cabinet crisis (with technocratic EU-friendly PM candidate Carlo Cottarelli unlikely to get Parliament approval), will be the key EUR driver this week. The single European currency has seen a mild boost earlier, as markets were relieved that the candidacy of Eurosceptic Finance Minister Paolo Savona was blocked. With the populist coalition seeking reappraisal of EU fiscal and monetary rules, any news that Eurosceptic candidates are prevented from gaining access to future Italian cabinet can provide additional support to EUR (and vice versa if populists gain electoral ground).

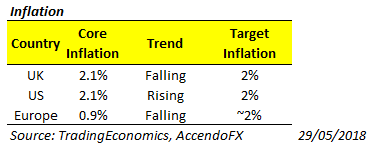

Release of Eurozone economic data (Weds, 30 May) will provide further evidence for the state of major European economies, most importantly German retail sales (expected to improve to best figures since January), unemployment (with seasonally adjusted rate expected to show lowest jobless levels since 1980), while inflation is expected to accelerate to 1.9% YoY (highest levels since April 2017). These figures, especially inflation, if confirmed, could give ECB cause to reassess their policy of not hiking interest rates, with potential impact on EUR, if German inflation continues growing.

Further evidence of the same could come in a day later (Thurs, 31 May) when Eurozone inflation and unemployment data will also be released (with core inflation projected to accelerate YoY, while unemployment remains in line with previous months).

USD

A mix geopolitics and macroeconomic indicators will move USD this week. News of progress on the geopolitical front will give further support to the Dollar. Key news to look out for: will China make a firm commitment for additional imports of US agricultural goods in US-China trade talks, and will Trump/Kim be able to agree to a firm date and agenda for their on-again/off-again summit in Singapore.

In macroeconomic data supporting USD this week will be release of US Q1 GDP 2nd estimate figures (Weds, 30 May), projected to dial back from previous quarter, Personal Spending and Income data (Thurs, 31 May), which is expected to rise MoM, as well as all important Non-Farm Payrolls (Fri, 1 June), also expected to show an improvement over previous month. With US economy recently experiencing a string of positive macroeconomic figures, further good news on that front will give additional strength to USD against peer currencies.

(Sign up here to receive our daily live macro-calendar)

Major UK Economic Data

00:01 BRC Shop Price Index

Major Intl Economic Data

07:00 Retail Sales (Germany)

08:55 Unemployment (Germany)

13:00 Inflation (Germany)

13:30 GDP (US)

Thursday 31 May

Major UK Economic Data

00:01 GfK Consumer Confidence

09:30 Net Consumer Credit

Major Intl Economic Data

02:00 NBS Manufacturing PMI (China)

10:00 Unemployment, Inflation (Eurozone)

13:30 Personal Income/Spending (US)

Friday 01 June

Major UK Economic Data

09:30 Manufacturing PMI

Major Intl Economic Data

02:45 Caixin PMI (China)

13:30 Non-farm Payrolls (US)

Technicals

Technicals

Technicals

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance. Prepared by Michael van Dulken, Head of Research

Comments are closed.