This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

The strongest factors influencing the direction and momentum of Foreign Exchange (FX) rates are changes in the key interest rates, themselves highly sensitive to macroeconomic data such as inflation and economic growth. Higher interest rates tend to render the currency more attractive (and vice versa) which in turn can result in it strengthening versus other currencies.

In the UK, interest rate policy is determined by the Bank of England’s (BoE) Monetary Policy Committee (MPC), which meets several times a year and whose decisions are closely watched by all FX traders, especially those trading Pound Sterling (GBP).

In the US, key interest rate decision-making body is the Fed’s Federal Open Market Committee (FOMC), influencing the US Dollar (USD), while for the single currency Euro (EUR) in the Eurozone, it is the European Central Bank (ECB).

The following events this week could have a major impact on FX markets.

GBP

This week will see the publication of three pieces of crucial UK data, which could drive the Pound and influence the BoE’s June rate setting decision.

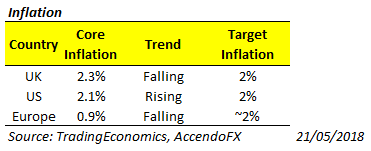

Firstly, April inflation (CPI; Weds, 9:30am), with the Core metric (the BoE’s preferred measure, excluding volatile goods like energy, food, alcohol and tobacco) expected to have slowed further, falling to 2.2%, the lowest since April 2017 and closer to the Bank’s 2% target. Falling inflation is a product of UK consumers discouraged from spending as economic growth slows and Brexit worries mount.

Secondly, April Retail Sales (Thurs, 9:30am) are expected to show a rebound from disappointing March data, damaged by a cold weather spell, although the annual rate of growth is expected to drop back to close to 0.1%, lowest level since November, echoing the woes of the high street.

Lastly, the second estimate for UK Q1 GDP (economic growth; Fri, 9:30am) is itself expected to confirm a fourth consecutive quarter of slowing.

All three recently compelled the BoE to hold off from raising UK interest rates at the 10 May meeting, instead preferring to continue monitoring inflation and GDP data for a pickup, which would require it to act to tame inflationary forces.

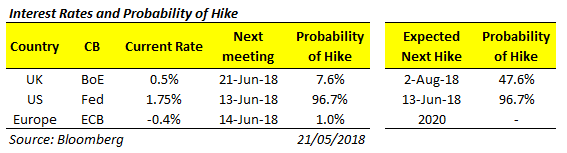

Markets are now expecting a hike on 2 Aug or 13 Sept MPC meetings (Source: Bloomberg)

EUR

Whilst Brexit negotiations rumble on, the geopolitical focus and main influencer for the Euro could well be the outcome of Italian cabinet negotiations. The anti-establishment Five-Star Movement and League parties are close to forming the first Eurosceptic government coalition in Europe. EUR is thus under pressure amid populist calls for an overhaul of EU fiscal and monetary rules.

In terms of data, PMI Services and Manufacturing flash estimates for May (Weds, 8-9am) may help with gauging Q2 growth in US and major European economies. EUR could be put under additional pressure vs USD with Eurozone figures forecasted to show a slight contraction, while the US figures tick higher.

German Chancellor Angela Merkel is in China to discuss trade and market access on Thurs. A successful outcome of these talks could lift EUR vs major peers. Merkel is expected to tread more carefully than US President Trump has in his own China trade negotiations.

USD

A breakthrough in US-China trade negotiations is providing further support for the USD, with news that both parties might be close to a more amicable solution. The US side has officially signalled willingness to compromise, with Treasury Secretary Mnuchin remarking that the imposition of tariffs on some Chinese exports has been put “on hold”.

The crux of the issue lies in determining which specific concessions China is preparing to offer the US and how much it is willing to decrease its trade surplus, in turn reducing the US deficit, a major Trump goal. The United States has been pushing heavily for China to purchase more US agricultural and industrial goods. The Dollar may react positively to any additional news that confirms a swift end to the recent trade stand-off.

Back to Central Banks on Wednesday, which will see detailed minutes from the FOMC 2 May meeting released. Economists will be scrutinising the language used by Fed’s central bankers to discuss growth and inflation in an effort to gain further insight and decipher the prospects and timing of future rate hikes (the next one expected at June 13 meeting, Source: Bloomberg).

(Sign up here to receive our daily live macro-calendar)

Major UK Economic Data

9:30 Inflation, House Prices

Major Intl Economic Data

8-9am Services/Manufacturing PMI Flash (Eurozone)

14:45 Services/Manufacturing PMI Flash (US)

15:00 New Home Sales (US)

19:00 FOMC May 2 Meeting Minutes (US)

Major UK Economic Data

09:30 Retail Sales

Major Intl Economic Data

07:00 GfK Consumer Confidence (Germany)

07:00 Q1 GDP Growth (Germany)

14:00 House Price Index (US)

15:00 Home Sales (US)

Major UK Economic Data

09:30 Q1 GDP, Index of Services, BBA Home Loans, Exports/Imports

Major Intl Economic Data

– OECD Economic Forecasts (Ezone)

09:00 IFO Surveys (Germany)

13:30 Durable Goods Orders (US)

15:00 U. of Michigan Sentiment (US)

Technicals

Technicals

Technicals

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance. Prepared by Michael van Dulken, Head of Research

Comments are closed.