This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

As foreign exchange traders return to their desks, news of another North Korean nuclear test have abruptly impacted FX markets. Unless further provocations take place this week, however, the politics and central bank heavy calendar is expected to once again become the primary driver of market sentiment.

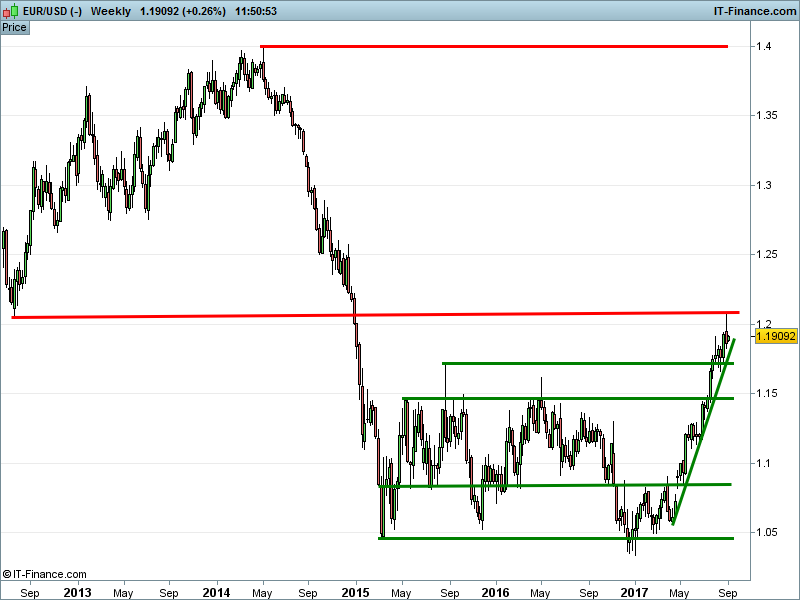

The headline event of the week takes place on Thursday, with policymakers from the European Central Bank (ECB) meeting to provide their latest monetary policy update. While many are hoping that ECB chief Mario Draghi will provide some a firm date for the introduction of its long-awaited Quantitative Easing (QE) taper, the ongoing Euro rally is likely to take a prominent role in proceedings.

Having already noted that Euro strength is damaging Eurozone exporters while dampening all-important inflation, policymakers will likely be unwilling to let the currency pairing rally further, something a hawkish QE taper would likely cause. Consequently, analysts are unsure as to whether Draghi will announce the taper this week, or choose to delay the announcement until the central bank’s meeting on 26 October.

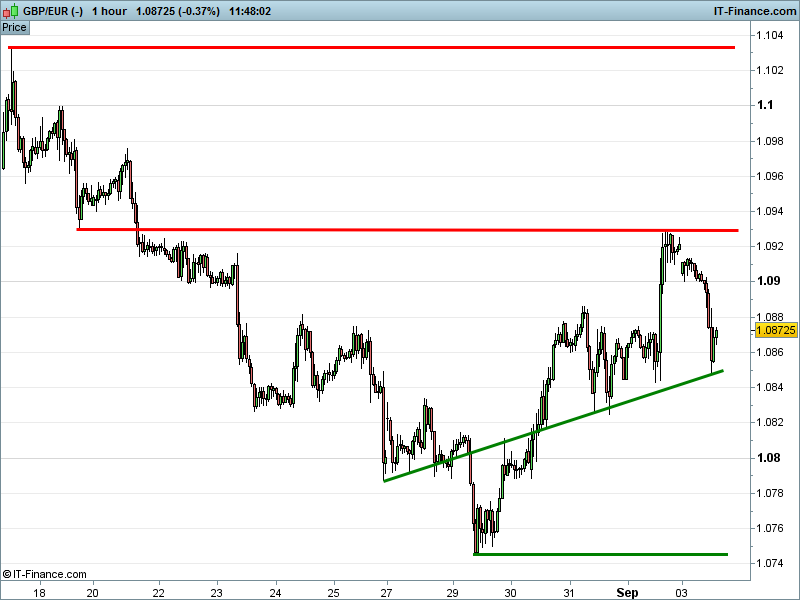

An indication that the taper will begin shortly would likely see the Euro’s 13% year-to-date rally against the USD continue, while a delay may offer some further respite for Sterling, having recovered just over 1% from last week’s fresh 10-month lows.

Anglo-American politics will also be in focus this week, as both UK and US governments return from their summer breaks to pressing matters.

UK parliament returns on Tuesday with Brexit remaining top of MPs’ priority list, most notably in the form of the ‘Great’ Repeal Bill. The bill, which would allow the government to turn EU statute into UK law with little oversight, is subject to a commons debate on Thursday where tempers are expected to fray as supporters of Brexit battle with Remainers on both sides of the aisle.

With a working parliamentary majority of just 13, only seven Tory MPs would need to vote against the bill for it to fail in parliament, however there may be room for some Labour MPs from leave-voting areas to vote with the government. A defeat would likely see fresh Sterling weakness as the united front for Brexit talks seemingly breaks down, while a victory for PM May and the government may help to allay fears of discord within the Brexit negotiating team.

Meanwhile, across the pond, US Congress returns to the imminent threat of government shutdown as the deadline date to raise the US debt ceiling looms. Representatives have until 30 September to agree to lift the credit limit, something that the recent tropical storm Harvey may have some part in playing.

By tying in the raising of the debt ceiling to delivering aid for the Harvey-struck state of Texas, the Trump administration could receive comprehensive backing from both parties, helping to avoid a costly government shutdown. While a vote is not expected to take place this week, news of the success or failure of cross-party talks could dictate the dollar in the run up to the key deadline date.

US central bank speakers could spice up the dollar in the mean time, with seven separate policymakers all scheduled to share thoughts after Monday’s Labor Day holiday.

Top tier macro data this week comes in the form of global PMI Services readings (Tuesday/Wednesday), US Economic Optimism and Durable Goods Orders (Tuesday; 3pm), German Industrial Production (Thursday; 7am), the final reading of Eurozone Q2 GDP (Thursday; 10am), Chinese Trade data (Friday; 3am), UK ONS/BoE Inflation Expectations and Industrial, Manufacturing & Construction Output (all Friday; 9:30am).

Key data this week (Sign up here to receive our daily live macro-calendar)

—

UK Economic Announcements

00:01 BRC LfL Sales

09:00 New Car Sales

09:30 PMI Services

Intl Economic Announcements

01:30 PMI Services (JP)

02:45 Caixin PMI Services (CN)

05:30 RBA Rate Decision (AUS)

8:45-9am PMI Services (European; Various)

10:00 Retail Sales (EZ)

14:45 ISM New York (US)

15:00 IBD/TIPP Economic Optimism, Durable Goods Orders (US)

—

Intl Economic Announcements

02:30 GDP (AUS)

07:00 Factory Orders (DE)

08:30 Construction PMI (DE)

09:10 Retail PMI (European; Various)

12:00 MBA Mortgage Applications (US)

13:30 Trade Balance (US)

14:45 Services PMI (US)

15:00 ISM Services (US)

—

UK Economic Announcements

08:30 Halifax House Prices

Intl Economic Announcements

06:00 Leading & Coincident Index (JP)

07:00 Industrial Production (DE)

10:00 Q2 GDP (EZ)

12:45 ECB Monetary Policy Update (EZ)

13.30 Weekly Jobless Claims (US)

16:00 EIA Crude Oil inventories (US)

UK Economic Announcements

09:30 Industrial, Manufacturing & Construction Output

09:30 BoE/ONS 12-Month Inflation Expectations

13:00 NIESR GDP Estimate

Intl Economic Announcements

00:50 Q2 GDP (JP)

03:00 Imports, Exports & Trade Balance (CN)

07:00 Trade Balance (DE)

15:00 Wholesale Inventories (US)

18:00 Baker Hughes Rig Count (US)

For information on deliverable FX, including how you can save thousands on currency exchange, put in a call to our trading floor on 0203 051 7461. It’s all part of the service!

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance. Prepared by Michael van Dulken, Head of Research

Comments are closed.