Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

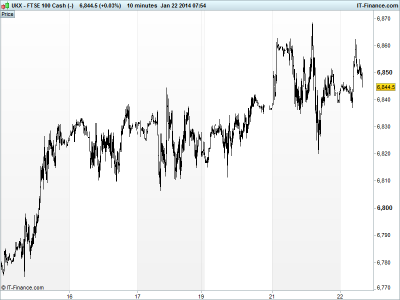

UK 100 called to open +15pts at 6845, back up above the 6840 mark after a brief bout of weakness into the European close, with the IMF’s upgrade to the world economic outlook (biggest upgrade to UK, developed nations also upped, but well flagged) failing to boost sentiment any further amid a light data line-up due to some cautious IMF comments relating to Eurozone deflation, speculation of a think tank report on the Fed and Eurozone liquidity in focus after ECB operations.

US markets closed mixed in their first day back after a long weekend, but held back by more bad weather affecting the North-East of the country and losses by the likes of IBM, ahead of disappointing results as revenues fell on key emerging market weakness.

Note J&J, Verizon Communications and Halliburton all giving up ground in response to Q4 updates. US earnings season, which was/still is a worry, given lofty equity valuations, has still delivered a 67% success rate this for Q4, but only after many expectations were managed down.

Overnight, Asian bourses mixed, with Japan’s Nikkei and Hong Kong positive, the former helped by the prospect of more QE from an upbeat BoJ held policy but warned that rising inflation may slow, and the latter on the back of a second up day for China stocks as money-market rates continue to ease thanks to PBOC intervention.

Australia’s ASX in the red, however, as much hotter than expected Q4 inflation readings put paid to another RBA rate cut, seeing the AUD strengthen hurting exporters. Consumer confidence also fell to 6-month lows after recent unemployment and housing data and a production update from miner BHP Billiton (BLT) fell short of consensus.

In focus today, we have UK unemployment data seen improving yet further, adding to the speculation about a rate-rise being even closer than forward guidance suggests, especially given the recent drop in inflation to the BoE’s 2% target. The BoE’s most recent policy minutes could be could be more important than the jobs data. Beware comments from Davos World Economic Forum.

Results-wise, in the US later we have United Technologies, General Dynamics and Motorola solutions before the US open, and eBay after the close. This morning we have had London updates from Whitbread (Chairman stepping down) and trading updates from Land Securities, JD Wetherspoon, WH Smith and Sage group.

UK 100 tested 6840 yesterday, but recovered back above overnight. Resistance again around 6865. Note intersecting trendline of resistance from 23 Dec across January rising highs. Uptrend alive, but with some bumps along the way.

In FX, the USD index down at 81.2 giving up a little ground. GBP/USD broken above Jan falling highs and close to testing 1.65 thanks to USD weakness and possibility of hawkish BoE minutes this week and more improvement in jobs data.

EUR/USD still in 2014 downtrend, but bounce off 1.35 continued although slowed up overnight. USD/JPY pretty much unmoved at 104.3 after BoJ minutes despite prospect of more QE on rising inflation stalling. AUD/USD up around 0.888 on hotter inflation data, but not above recent breakdown level.

Gold fallen back to $1240 after its recent strength to $1260. Rising lows from 8 Jan breached. USD weakness not helping. Possibly hindered by better IMF outlook negating safehaven demand.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- US IBM Q4 Results Revenues miss, EPS beat

- US Texas Instruments Q4 results Revenues beat, EPS in-line

- AU Consumer Price Inflation Beat, much stronger (AUD)

- CN MNI Business indicator Deteriorated

- JP All-Industry Activity Index In-line, improved

- JP Sentiment indices Improved

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- BHP Billiton says Q2 iron ore production 48.9 mln tonnes

- BHP says Dec qtr iron ore output up, petroleum slips

- Whitbread Chairman Anthony Habgood to step down

- WH Smith Christmas sales down, margins up

- Land Securities says well-placed, seeing strong demand

- Findel posts 4.6 pct rise in second-half sales

- London Mining hits 2013 iron ore production target

- J D Wetherspoon posts 6.7 pct rise in Q2 sales

- Sage says trading in-line across all regions

- AstraZeneca’s diabetes drug Xigduo approved in Europe

- Grainger gets go ahead for Kensington residential developments

- Emis says trading for the year in line