Markets Overview: (Source: Bloomberg, FT, Reuters, DJ Newswires)

UK 100 called to open +15pts at 6850, as 2014 market optimism gets a fillip from China’s central bank PBOC intervening in the money markets to cool the squeeze in interbank-lending lending/borrowing rates which had moved up in repose to the seasonal New Year cash drawdown by the public. Remember though, China still trying to rein in lax lending due to risk of defaults.

Asian markets positive, thanks to the China news (intervention, and continued relief from GDP yesterday buoying global sentiment) and with no handover from the US on account of the Martin Luther King day public holiday, and to-be-expected quiet session in Europe, although the UK 100 outperformed on hopes (Telegraph) of an IMF growth upgrade today.

In the US, however, on the topic of QE3 tapering, the WSJ’s Fed-watcher Hilsenrath sees another $10bn cut next week, with December’s jobs report failing to curb the bank’s view of solid growth. Ahead of the BOJ update tomorrow, Japan, economy minister Amari said the country still faces deflationary risks and Credit Suisse claims core-core inflation still actually negative.

Comments from Europe include EU president Barrosso seeing the EU at a turning point in crisis and growth returning slowly. Counterpart Van Rompuy also warned the SRM for banking union would face a 12-month delay if an agreement not reached before May EU elections.

In Greece, PM Samaras sees return to growth after 6 years of recession while Spain’s PM Rajoy will approve an income tax cut for 2015. Note also Ireland’s 5yr borrowing costs falling yet further, below the UK’s and to the same as the US, as investors cheered ratings agency Moody’s upgrade from junk. Could it regain an A rating from 2 of the big 3 in 2014, signalling return to health?

While macro data was lacking, note on the political front that EU ministers have approved easing of sanctions on Iran, but the country has had its invitation to talks on Syria rescinded due to its failure to commit to a transitional government and its backing of Bashar al-Assad’s regime.

In focus today, as the US returns to trading, we have ZEW Surveys seen edging higher in Germany, and a mixed expectations for UK CBI trends. Lots of central bank speakers (BoE’s Haldane, ECBs Nowotny, EU’s Rehn) and the IMF releasing its updated 2014 world economic outlook which could see the UK upgraded by more than any other nation.

Results-wise, we have US oil services company Baker Hughes reporting Q4 numbers followed by Verizon Communications which will be of interest to Vodafone shareholders given its stake in the joint venture. Before the US open another US oil services company updates – Halliburton and then we have Texas Instruments and IBM which are considered by some as economic barometers.

With several Oil services companies reporting today, note China’s biggest offshore oil and gas producer Cnooc forecasting output growth below its targeted averages for the five years through 2015. Note also results from Unilever in the UK this morning also look to have beaten expectations despite revenues being hit by a slowdown in some emerging markets, FX and divestments.

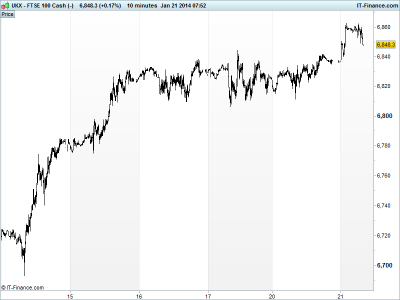

UK 100 broken out of 6805-6840 range to test 6860 overnight. More progress towards the 6875 May highs and then all-time high 6950. Uptrend still alive. Rising 2-day lows may help with support.

In FX, the USD index back at 81.3 after some mild weakness yesterday, despite talk of another $10bn taper. GBP/USD testing 2014 falling highs of 1.645 thanks to USD weakness and possibility of more hawkish BoE minutes this week. EUR/USD bounced off 1.35 after falling below trendline of rising lows from early July. USD/JPY back up above 104.5 helping Nikkei while AUD/USD holding around 0.88 recent breakdown.

Gold made a bit more progress, almost testing $1260 on some USD weakness and safehaven seeking on China GDP and global growth uncertainty. Rising support now possible at $1245. Next hurdle just shy of $1270 in mid-December.

For any help you may require placing trades or in terms of market information, put a call in to our trading floor – all part of the service.

Overnight Macro Data: (Source: Reuters/DJ Newswires)

- JP Supermarket Sales Growth Miss, deteriorated

See Live Macro calendar for all details

UK Company Headlines: (Source: Reuters/DJ Newswires)

- Melrose proposes capital return to shareholders

- IQE sees 2013 revenue of at least £126m

- Cairn on track to drill nine exploration wells this year

- Optos first-quarter revenues dip, reiterates guidance

- Sirius Minerals signs polyhalite supply deal with U.S.-based company

- Rolls-Royce expected to make a public offer on Wartsila -report

- SDL sees full-year adjusted pretax of £8-8.3m

- IMI outlines shareholder payout, stock consolidation

- Unilever 2013 turnover down 3%

- William Sinclair swings to a pretax profit

- Restaurant Group CEO Page to retire in August 2014

- Hochschild Mining tops 2013 silver production target

- Petra recovers exceptional 29.6 carat blue diamond

- Russia’s Polymetal says Q4 revenue down 14% y-on-y

- SABMiller 3rd quarter sales rise

- Newriver Retail to raise £75m in a placing