WPP (WPP.L) 30-01-20

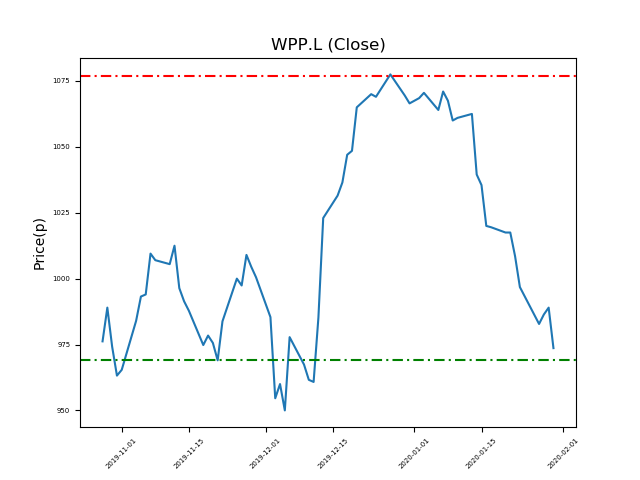

Will WPP (WPP.L) break below the 969p support, or bounce to highs at 1077p (+11%)?

- Currently trading around the 969p support at 967.2p (at time of writing).

- Will the shares rally to recent highs of 1077p? (+11%).

- Shares -10% from 12-month highs; +20% from 12 month lows.

Latest News

20 Jan: Goldman Sachs has downgraded its rating on WPP Group (WPP) to neutral (from buy).

16 Jan: UBS reiterates its buy rating on WPP Group (WPP) and increased the target price to 1175p (from 1125p).

15 Jan: Bank of America Merrill Lynch has downgraded its rating on WPP Group (WPP) to underperform (from neutral) and reduced the target price to 900p (from 1030p).

14 Jan: JP Morgan Cazenove reiterates its overweight rating on WPP Group (WPP) and increased the target price to 1150p (from 1100p).

11 Dec: JP Morgan Cazenove reiterates its overweight rating on WPP Group (WPP) and reduced the target price to 1100p (from 1125p).

27 Nov: BMO Capital Markets reiterates its market perform rating on WPP Group (WPP) and increased the target price to 1100p (from 1000p).

19 Nov: Mark Read, Chief Executive Officer, has transferred in 10,272 shares within the firm on the 15th November 2019. This Director currently has 201,627 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires