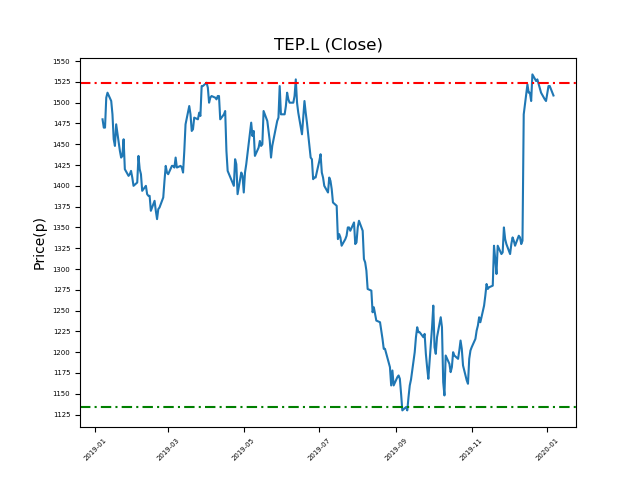

Telecom Plus PLC (TEP.L) 06-01-20

Telecom Plus PLC (TEP.L): will the shares break resistance or fall back to the 1134p support again? (-24%)?

- Now testing the 1524p resistance, currently trading at 1504p (at time of writing).

- This resistance has been robust to date.

- Will the price action return toward support at 1134p? Does this provide an opportunity to short sellers? (-24%).

- As always, price action can be influenced by breaking news. Be mindful of news and new developments.

- Shares -2% from 12-month highs; +33% from 12 month lows.

Latest News

20 Nov: JP Morgan Cazenove reiterates its neutral rating on Telecom plus (TEP) and reduced the target price to 1450p (from 1500p).

19 Nov: Telecom Plus, the Utility service provider, posted a 9.2% increase in H1 profit, due to increased customer acquisition. Pre-tax profit for the half-year to the end of September in increased to £21.1m, up from £19.3m.

18 Jun: Telecom Plus announced a 4.9% increase in end of year profit, driven by new customer acquisitions and a small increase in sales.

17 Apr: Telecom Plus warned that its end of year profit would be toward the bottom of its stated guidance range.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires