Standard Chartered PLC (STAN.L) 21-01-20

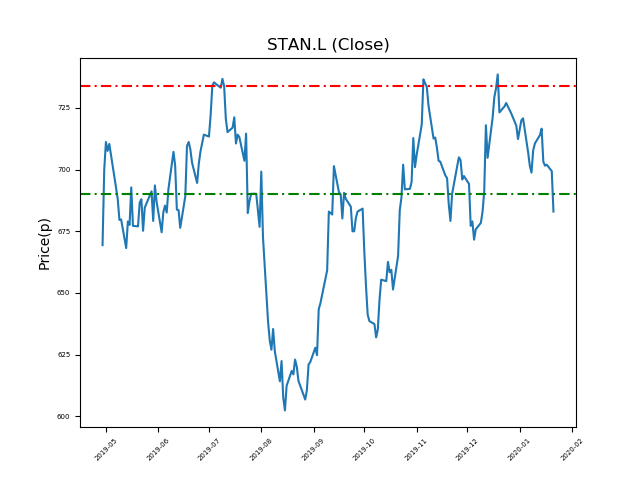

Standard Chartered PLC (STAN.L): will it break the 690p key support level, or bounce to highs of 734p (+6%)?

- Currently trading around the 690p support. The current price is 689p (at time of writing).

- Support levels like these are often used by traders to assist with decision making.

- Strong support levels often suggest that there may be ‘hot money’ looking to buy at the key level. Of course, valuations can change.

- Will the share price rally again to recent highs of 734p? (+6%).

- Shares -6% from 12-month highs; +19% from 12 month lows.

Latest News

15 Jan: Barclays Capital reiterates its underweight rating on Standard Chartered (STAN) and increased the target price to 650p (from 630p).

22 Nov: Goldman Sachs reiterates its conviction buy rating on Standard Chartered (STAN) and cut the target price to 1000p (from 1020p).

15 Nov: Exane BNP Paribas has downgraded its rating on Standard Chartered (STAN) to underperform (from neutral).

14 Nov: Goldman Sachs reiterates its conviction buy rating on Standard Chartered (STAN) and increased the target price to 1020p (from 990p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires