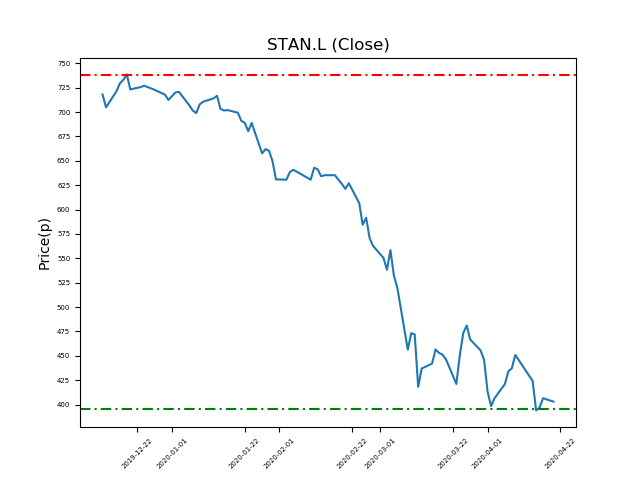

Standard Chartered PLC (STAN.L) 20-04-20

Will Standard Chartered PLC (STAN.L) shares break below the 395p support, or return to highs of 738p (+83%)?

- Currently close to the 395p support at 402.5p (at time of writing).

- This has been identified for ostensibly strong support level. Traders should consider whether they think it will hold up again.

- Will the price bounce again to recent highs at 738p? (+83%).

- Technical traders should consider potential news and developments. Check our website and the press for updates in future.

- Shares -45% from 12-month highs; +2% from 12 month lows.

Latest News

16 Apr: Barclays Capital reiterates its underweight rating on Standard Chartered (STAN) and reduced the target price to 425p (from 550p).

01 Apr: Standard Chartered followed other UK banks by withdrawing dividend payments to conserve cash, due to the current pandemic. Management announced that it had suspended its 2019 final dividend payment.

31 Mar: Goldman Sachs reiterates its buy rating on Standard Chartered (STAN) and reduced the target price to 850p (from 870p).

17 Mar: HSBC has upgraded its rating on Standard Chartered (STAN) to hold (from reduce) and reduced the target price to 480p (from 590p).

05 Mar: Goldman Sachs reiterates its buy rating on Standard Chartered (STAN) and reduced the target price to 870p (from 970p).

02 Mar: Barclays Capital reiterates its underweight rating on Standard Chartered (STAN) and reduced the target price to 550p (from 650p).

02 Mar: UBS reiterates its neutral rating on Standard Chartered (STAN) and reduced the target price to 590p (from 630p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires