SSE (SSE.L) 06-04-20

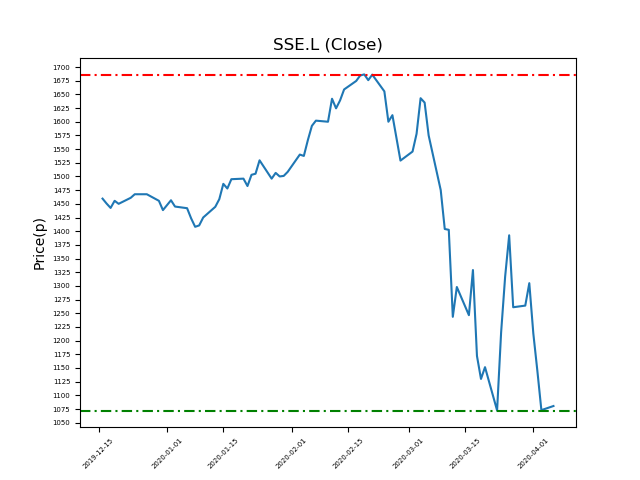

Will SSE (SSE.L) shares break below the 1072p support, or return to highs of 1686p (+53%)?

- Currently close to the 1072p support at 1096.85p (at time of writing).

- This has been identified for ostensibly strong support level. Traders should consider whether they think it will hold up again.

- Will the price bounce again to recent highs at 1686p? (+53%).

- Technical traders should consider potential news and developments. Check our website and the press for updates in future.

- Shares -35% from 12-month highs; +8% from 12 month lows.

Latest News

03 Apr: Berenberg reiterates its hold rating on SSE (SSE) and reduced the target price to 1300p (from 1350p).

03 Apr: Deutsche Bank reiterates its hold rating on SSE (SSE) and reduced the target price to 1100p (from 1350p).

02 Apr: Bernstein reiterates its outperform rating on SSE (SSE) and reduced the target price to 1500p (from 1600p).

31 Mar: Credit Suisse has downgraded its rating on SSE (SSE) to neutral (from outperform) and reduced the target price to 1200p (from 1250p).

27 Mar: SSE, the power utility, cautioned that profits for the year would be at the lower end of previous guidance, even before considering the impact of the pandemic, though dividend plans remained.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires