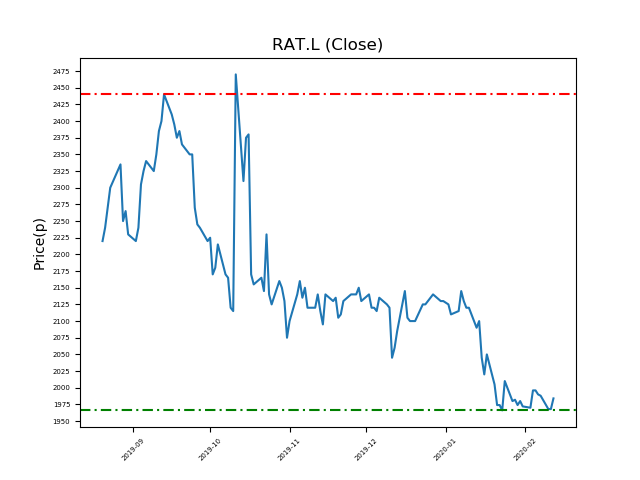

Rathbone Brothers (RAT.L) 12-02-20

Will Rathbone Brothers (RAT.L) fall beyond the 1966p support level, or will we see a retest of 2440p? (+22%)

- The stock is near support at 1966p, now trading at 1988p (at time of writing).

- Whilst the past does not always repeat itself, the support level has held up well.

- From here, will buying pressure return to drive the price back to 2440p? (+22%).

- As always, be aware of news and events that can change the market’s perception of value – this can lead to key levels being broken.

- Shares -21% from 12-month highs; +1% from 12 month lows.

Latest News

24 Jan: RBC Capital Markets has upgraded its rating on Rathbone Brothers (RAT) to outperform (from sector performer) and reduced the target price to 2240p (from 2450p).

13 Jan: Liberum Capital reiterates its hold rating on Rathbone Brothers (RAT) and increased the target price to 2100p (from 2070p).

09 Jan: Rathbone Brothers witnessed a 14.3% climb in funds under management and administration to the end of the year. The company announced it had £50.4 billion under management.

28 Nov: Rathbone Investment Management, the subsidiary of Rathbone Brothers, has taken over the personal injury and Court of Protection segment of Barclays Wealth.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires