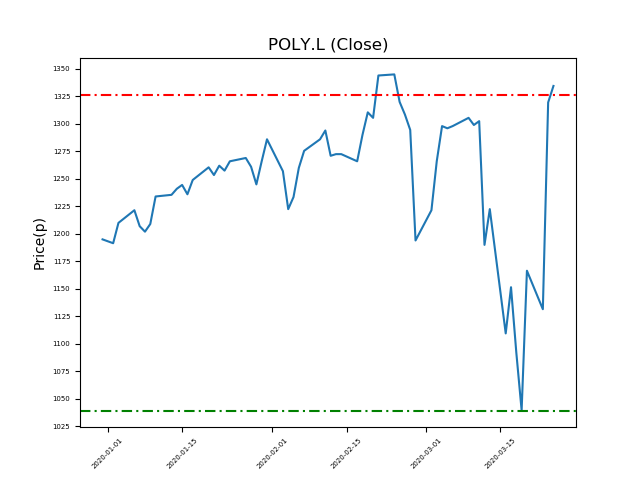

Polymetal International (POLY.L) 25-03-20

Will Polymetal International (POLY.L) break the key resistance line this time, or will it retest the 1039p support once more? (-20%)?

- Currently trading at 1308.5p, close to the 1326p resistance (at time of writing).

- Will the share price fall to recent support of 1039p? (-20%). One for the short-seller?

- Check the Accendo website and other news outlets for updates. Trading patterns can be disrupted by company news and world events.

- Shares -2% from 12-month highs; +69% from 12 month lows.

Latest News

13 Mar: Vitaly Nesis, Chief Executive Officer, has transferred in 11,047 shares within the firm on the 12th March 2020. This Director currently has 3,284,277 shares.

11 Mar: JP Morgan Cazenove has upgraded its rating on Polymetal International (POLY) up to overweight (from neutral) and increased the target price to 1500p (from 1290p).

06 Mar: JP Morgan Cazenove reiterates its neutral rating on Polymetal International (POLY) and increased the target price to 1290p (from 1120p).

04 Mar: RBC Capital Markets reiterates its outperform rating on Polymetal International (POLY) and reduced the target price to 1400p (from 1450p).

04 Mar: Polymetal International, the mining business, announced a 36% jump in profits for the year and raised its dividend by 71%. The company said it should continue to benefit from higher gold and silver values.

03 Mar: RBC Capital Markets reiterates its outperform rating on Polymetal International (POLY) and increased the target price to 1450p (from 1400p).

28 Feb: Citigroup reiterates its buy rating on Polymetal International (POLY) and increased the target price to 1600p (from 1060p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires