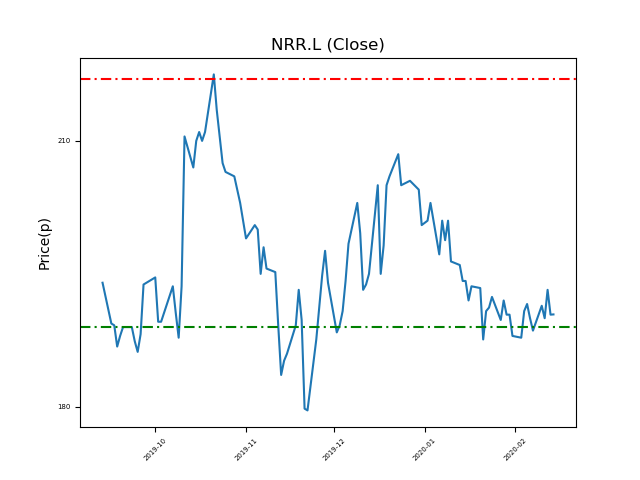

NewRiver REIT (NRR.L) 14-02-20

NewRiver REIT (NRR.L): will it break the 189p key support level, or bounce to highs of 217p (+14%)?

- Currently trading around the 189p support. The current price is 190.4p (at time of writing).

- Support levels like these are often used by traders to assist with decision making.

- Strong support levels often suggest that there may be ‘hot money’ looking to buy at the key level. Of course, valuations can change.

- Will the share price rally again to recent highs of 217p? (+14%).

- Shares -22% from 12-month highs; +29% from 12 month lows.

Latest News

28 Jan: Allan Lockhart, Chief Executive Officer, sold 148,750 shares within the firm on the 27th January 2020 at a price of 190p. This Director currently has 256,883 shares.

22 Jan: NewRiver REIT, the real estate investor, announced that footfall through its shopping centres declined 1.9% within Q3, but still beat the UK’s benchmark figures.

22 Jan: Liberum Capital reiterates its buy rating on NewRiver Retail Ltd (NRR) and reduced the target price to 240p (from 250p).

17 Dec: Peel Hunt reiterates its buy rating on NewRiver Retail Ltd (NRR) and increased the target price to 225p (from 200p).

10 Dec: Barclays Capital reiterates its equal weight rating on NewRiver Retail Ltd (NRR) and reduced the target price to 200p (from 215p).

03 Dec: NewRiver REIT announced it had taken over the pub group Bravo Inns for £17.9m, representing an earnings multiple of 6.8.

02 Dec: NewRiver REIT announced it had concluded the takeover of Sprucefield retail park in Northern Ireland for £40m (purchased from Intu Properties).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires