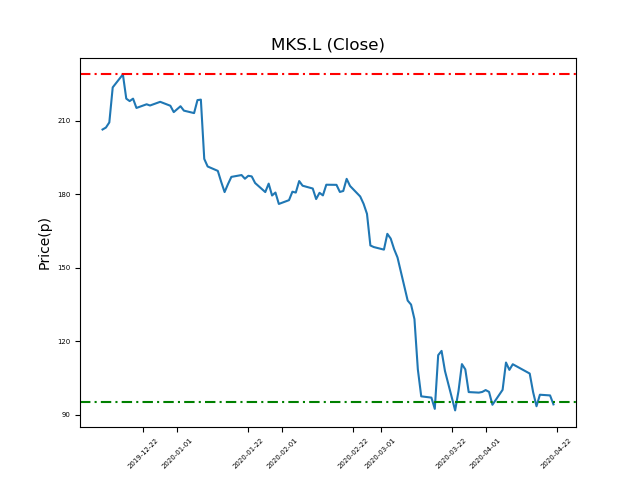

Marks and Spencer (MKS.L) 21-04-20

Will Marks and Spencer (MKS.L) shares break below the 95p support zone, or will it return to highs of 229p (+145%)?

- Currently trading around the 95p support at 93.17p (at time of writing).

- The price has tested this level repeatedly. Traders should be mindful of stop-loss placement.

- Highs of 229p have been seen in the recent past. Will we see this again? (+145%)

- Shares -66% from 12-month highs; +1% from 12 month lows.

Latest News

20 Apr: Goldman Sachs reiterates its buy rating on Marks & Spencer Group (MKS) and reduced the target price to 140p (from 150p).

17 Apr: Peel Hunt reiterates its hold rating on Marks & Spencer Group (MKS) and reduced the target price to 125p (from 200p).

15 Apr: Citigroup has downgraded its rating on Marks & Spencer Group (MKS) to neutral (from buy) and reduced the target price to 120p (from 265p).

01 Apr: Goldman Sachs reiterates its buy rating on Marks & Spencer Group (MKS) and reduced the target price to 150p (from 170p).

23 Mar: Barclays Capital reiterates its overweight rating on Marks & Spencer Group (MKS) and reduced the target price to 175p (from 250p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires