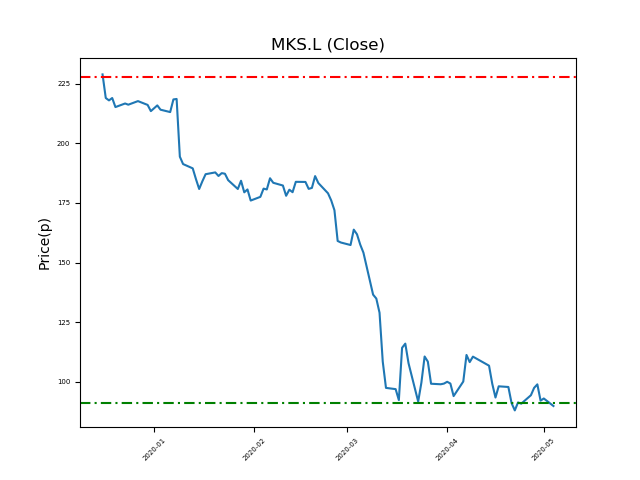

Marks and Spencer (MKS.L) 04-05-20

Will Marks and Spencer (MKS.L) break below the 91p support, or bounce to highs at 228p (+152%)?

- Currently trading around the 91p support at 90.46p (at time of writing).

- Will the shares rally to recent highs of 228p? (+152%).

- Shares -66% from 12-month highs; +2% from 12 month lows.

Latest News

30 Apr: Marks and Spencer, the UK retailer, appointed Tamara Ingram and Sapna Sood as non-executive directors, to take up their posts on 21st May this year.

29 Apr: Goldman Sachs reiterates its buy rating on Marks & Spencer Group (MKS) and reduced the target price to 120p (from 140p).

28 Apr: Marks & Spencer announced that it did not anticipate paying dividends in 2021 as the Covid-19 pandemic hits revenue.

24 Apr: Credit Suisse has upgraded its rating on Marks & Spencer Group (MKS) to outperform (from underperform) and reduced the target price to 125p (from 185p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires