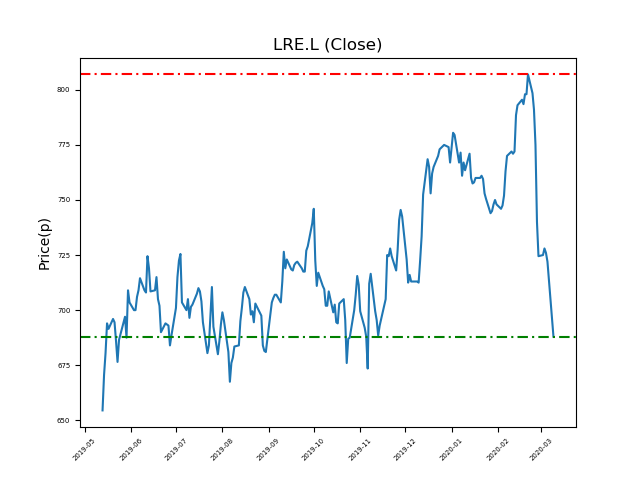

Lancashire Holdings Limited (LRE.L) 09-03-20

Will Lancashire Holdings Limited (LRE.L) shares break below the 688p support zone, or will it return to highs of 807p (+16%)?

- Currently trading around the 688p support at 691p (at time of writing).

- The price has tested this level repeatedly. Traders should be mindful of stop-loss placement.

- Highs of 807p have been seen in the recent past. Will we see this again? (+16%)

- Shares -14% from 12-month highs; +7% from 12 month lows.

Latest News

18 Feb: Peel Hunt reiterates its hold rating on Lancashire Holdings Ltd (LRE) and increased the target price to 760p (from 730p).

14 Feb: UBS reiterates its buy rating on Lancashire Holdings Ltd (LRE) and increased the target price to 870p (from 830p).

14 Feb: JP Morgan Cazenove reiterates its neutral rating on Lancashire Holdings Ltd (LRE) and increased the target price to 700p (from 695p).

13 Feb: Lancashire Holdings, the property and casualty insurer, announced an increase in profits as premiums grew again. In the annual results to 31 December, pre-tax profits increased to $119.5m, up from $33.6m.

03 Feb: Goldman Sachs today initiates coverage of Lancashire Holdings Ltd (LRE) with a buy rating and target price of 860p.

03 Feb: Barclays Capital reiterates its equal weight rating on Lancashire Holdings Ltd (LRE) and increased the target price to 781p (from 758p).

23 Jan: HSBC has downgraded its rating on Lancashire Holdings Ltd (LRE) to reduce (from hold) and reduced the target price to 551p (from 694p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires