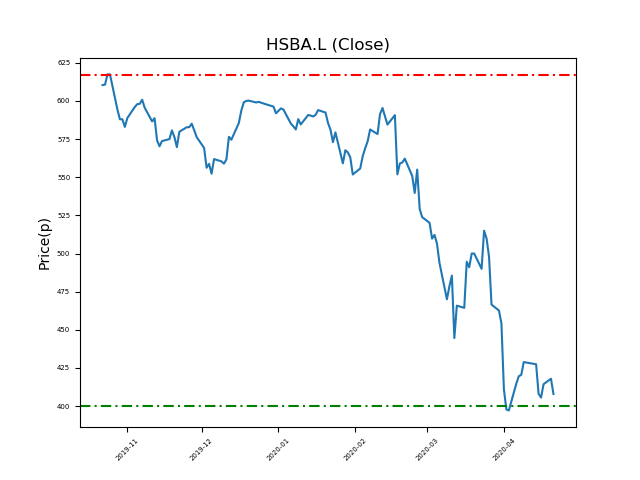

HSBC Holdings (HSBA.L) 21-04-20

Will HSBC Holdings (HSBA.L) shares break below the 400p support zone, or will it return to highs of 617p (+51%)?

- Currently trading around the 400p support at 407.45p (at time of writing).

- The price has tested this level repeatedly. Traders should be mindful of stop-loss placement.

- Highs of 617p have been seen in the recent past. Will we see this again? (+51%)

- Shares -40% from 12-month highs; +2% from 12 month lows.

Latest News

20 Apr: Citigroup reiterates its neutral rating on HSBC Holdings (HSBA) and reduced the target price to 410p (from 470p).

16 Apr: Barclays Capital reiterates its underweight rating on HSBC Holdings (HSBA) and reduced the target price to 420p (from 550p).

09 Apr: Credit Suisse has downgraded its rating on HSBC Holdings (HSBA) to neutral (from outperform) and reduced the target price to 515p (from 635p).

02 Apr: JP Morgan Cazenove reiterates its underweight rating on HSBC Holdings (HSBA) and reduced the target price to 510p (from 570p).

01 Apr: HSBC cautioned that the impact of the Covid-19 crisis would damage Q1 revenues. The bank also shelved plans to pay a fourth interim dividend.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires