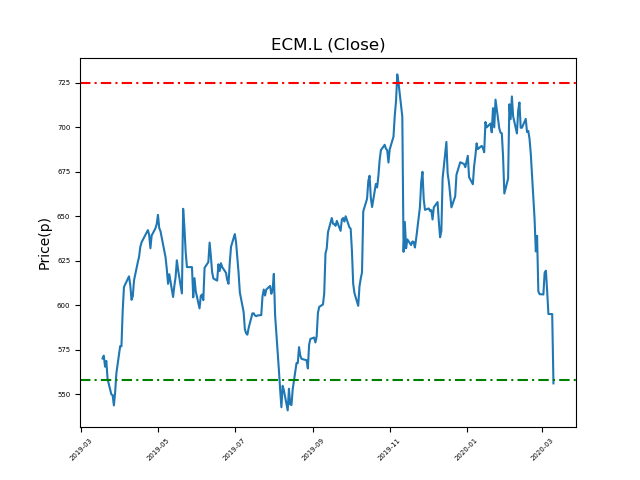

Electrocomponents (ECM.L) 10-03-20

Electrocomponents (ECM.L): will it break the 558p key support level, or bounce to highs of 725p (+29%)?

- Currently trading around the 558p support. The current price is 559.2p (at time of writing).

- Support levels like these are often used by traders to assist with decision making.

- Strong support levels often suggest that there may be ‘hot money’ looking to buy at the key level. Of course, valuations can change.

- Will the share price rally again to recent highs of 725p? (+29%).

- Shares -23% from 12-month highs; +3% from 12 month lows.

Latest News

19 Feb: Peel Hunt reiterates its hold rating on Electrocomponents (ECM) and increased the target price to 700p (from 650p).

11 Feb: Berenberg reiterates its buy rating on Electrocomponents (ECM) and increased the target price to 800p (from 715p).

05 Feb: JP Morgan Cazenove reiterates its overweight rating on Electrocomponents (ECM) and increased the target price to 811p (from 774p).

04 Feb: Electrocomponents, the industrial and electrical product company, said it witnessed slower growth within the first four months, blaming an uncertain economic environment.

16 Jan: JP Morgan Cazenove has upgraded its rating on Electrocomponents (ECM) up to overweight (from neutral) and increased the target price to 774p (from 651p).

08 Jan: UBS reiterates its buy rating on Electrocomponents (ECM) and increased the target price to 775p (from 725p).

29 Nov: UBS reiterates its buy rating on Electrocomponents (ECM) and increased the target price to 725p (from 705p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires