Diageo (DGE.L) 13-02-20

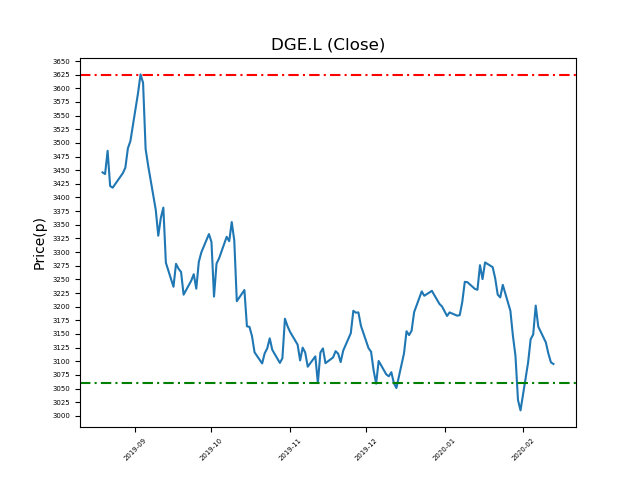

Will Diageo (DGE.L) shares break below the 3060p support zone, or will it return to highs of 3625p (+17%)?

- Currently trading around the 3060p support at 3078.5p (at time of writing).

- The price has tested this level repeatedly. Traders should be mindful of stop-loss placement.

- Highs of 3625p have been seen in the recent past. Will we see this again? (+17%)

- Shares -15% from 12-month highs; +5% from 12 month lows.

Latest News

11 Feb: Javier Ferrán, Chairman, bought 263 shares within the firm on the 10th February 2020 at a price of 3140.50p. This Director currently has 232,249 shares.

05 Feb: UBS reiterates its buy rating on Diageo (DGE) and reduced the target price to 3480p (from 3750p).

03 Feb: Barclays Capital reiterates its overweight rating on Diageo (DGE) and reduced the target price to 3580p (from 3870p).

03 Feb: Kepler Cheuvreux has upgraded its rating on Diageo (DGE) to buy (from hold) and increased the target price to 3700p (from 3400p).

03 Feb: Credit Suisse reiterates its outperform rating on Diageo (DGE) and reduced the target price to 3550p (from 3630p).

31 Jan: Bernstein reiterates its market perform rating on Diageo (DGE) and reduced the target price to 3370p (from 3400p).

31 Jan: Berenberg reiterates its hold rating on Diageo (DGE) and reduced the target price to 2720p (from 2860p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires