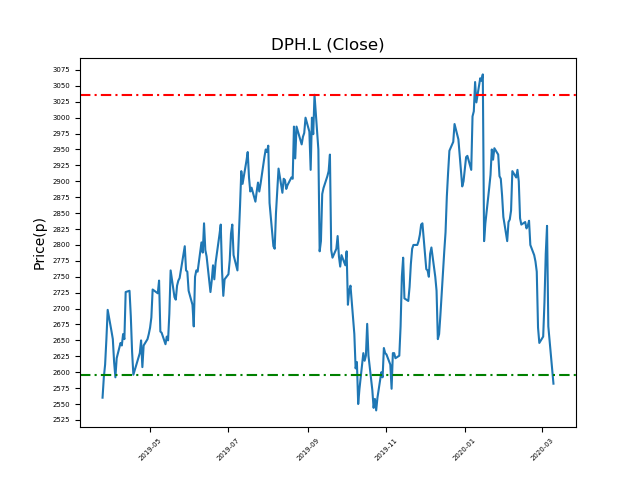

Dechra Pharmaceuticals PLC (DPH.L) 10-03-20

Will Dechra Pharmaceuticals PLC (DPH.L) shares break below the 2596p support, or return to highs of 3036p (+17%)?

- Currently close to the 2596p support at 2586p (at time of writing).

- This has been identified for ostensibly strong support level. Traders should consider whether they think it will hold up again.

- Will the price bounce again to recent highs at 3036p? (+17%).

- Technical traders should consider potential news and developments. Check our website and the press for updates in future.

- Shares -15% from 12-month highs; +9% from 12 month lows.

Latest News

25 Feb: JP Morgan Cazenove reiterates its overweight rating on Dechra Pharmaceuticals (DPH) and increased the target price to 3300p (from 3200p).

24 Feb: Dechra Pharmaceuticals, the veterinary pharmaceuticals group, announced that H1 profit grew by more than 100%, driven by ‘strong’ revenue Europe. However, the company cautioned investors of supply issues in North America.

21 Jan: Jefferies International has downgraded its rating on Dechra Pharmaceuticals (DPH) to hold (from buy) and reduced the target price to 2930p (from 3090p).

16 Jan: Dechra Pharmaceuticals announced that the full-year’s performance would be weighted more to the second half, which is unusual.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires