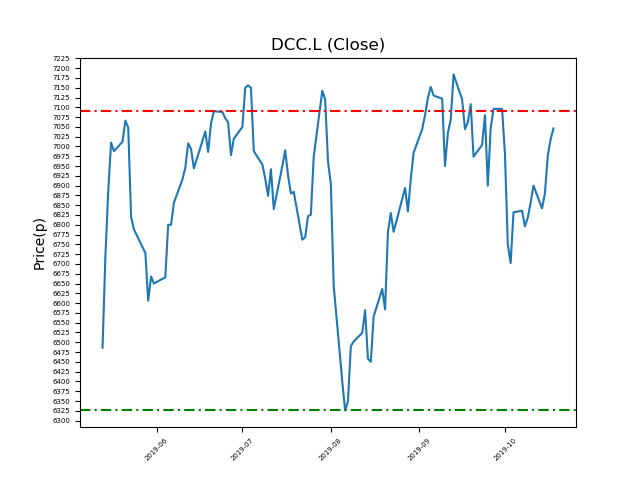

DCC (DCC.L) 18-10-19

Will shares in DCC (DCC.L) break upwards or fall back to the 6326p support yet again? (-10%)?

- Now trading close to 7090p resistance at 7028p (at time of writing).

- The resistance has been reliable recently. Will the resistance hold this time?

- Will the share price rebound once again to recent support of 6326p? (-10%).

- Technical traders should be mindful of price-sensitive news and events.

- Shares -2% from 12-month highs; +26% from 12 month lows.

Latest News

04 Oct: Berenberg reiterates its buy rating on DCC (DCC) and increased the target price to 8450p (from 8350p).

19 Jul: RBC Capital Markets reiterates its outperform rating on DCC (DCC) and reduced the target price to 9000p (from 9500p).

12 Jul: DCC stated that it had traded in-line with expectations and had seen ‘good growth’ in operating profit for Q1, partly due to acquisitions made in the year before.

07 Jun: Goldman Sachs reiterates its neutral rating on DCC (DCC) and reduced the target price to 7800p (from 7900p).

14 May: DCC, the support services group, reported higher full year profits as recent acquisitions helped drive ‘very strong’ growth in its natural gas business unit.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires