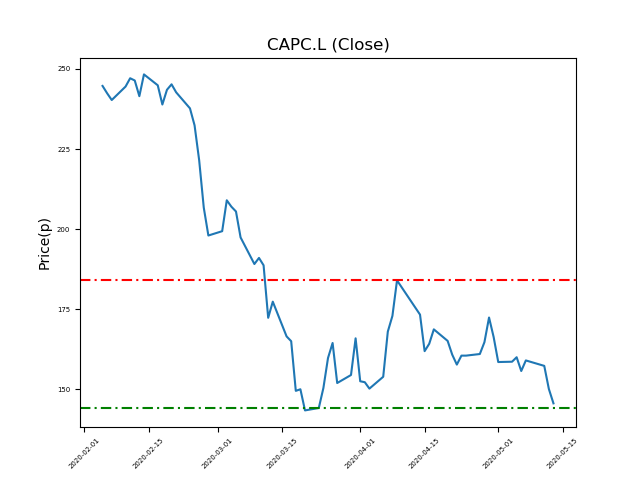

Capital & Counties Properties PLC (CAPC.L) 13-05-20

Will Capital & Counties Properties PLC (CAPC.L) break below the 144p support, or bounce to highs at 184p (+27%)?

- Currently trading around the 144p support at 144.9p (at time of writing).

- Will the shares rally to recent highs of 184p? (+27%).

- Shares -46% from 12-month highs; +1% from 12 month lows.

Latest News

06 May: Peel Hunt has downgraded its rating on Capital & Counties Properties (CAPC) to add (from buy) and reduced the target price to 180p (from 310p).

20 Apr: Michelle McGrath, Executive Director, bought 20,000 shares within the firm on the 17th April 2020 at a price of 166.21p. This Director currently has 20,000 shares.

20 Apr: Situl Jobanputra, Executive Director, bought 12,500 shares within the firm on the 17th April 2020 at a price of 166.21p. This Director currently has 62,500 shares.

15 Apr: Barclays Capital reiterates its underweight rating on Capital & Counties Properties (CAPC) and reduced the target price to 160p (from 200p).

09 Apr: HSBC has upgraded its rating on Capital & Counties Properties (CAPC) to buy (from hold) and reduced the target price to 211p (from 265p).

28 Feb: Barclays Capital reiterates its underweight rating on Capital & Counties Properties (CAPC) and reduced the target price to 200p (from 230p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires