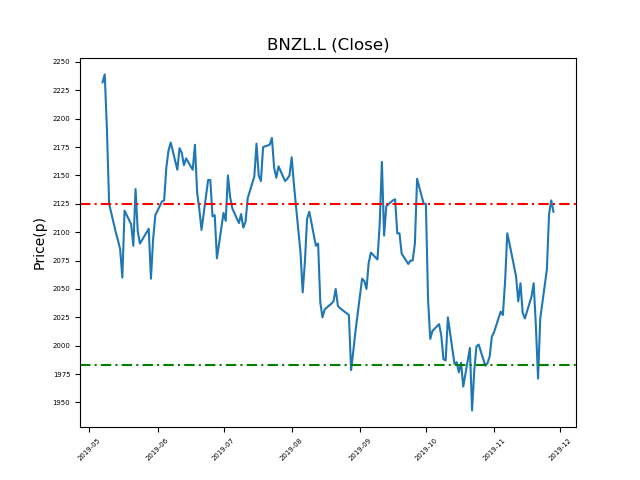

Bunzl (BNZL.L) 28-11-19

Will Bunzl (BNZL.L) break the key resistance level, or will it drop back to the 1983p support once more? (-6%)?

- Now trading near the 2125p resistance at 2124p (at time of writing).

- Will the shares fall again to recent support of 1983p? (-6%).

- Is this an opportunity for the short seller?

- Shares -16% from 12-month highs; +9% from 12 month lows.

Latest News

06 Nov: Goldman Sachs reiterates its buy rating on Bunzl (BNZL) and reduced the target price to 2500p (from 2700p).

24 Oct: Barclays Capital reiterates its overweight rating on Bunzl (BNZL) and reduced the target price to 2250p (from 2400p).

23 Oct: Brian May, Financial Director, exercised 17,382 shares in the firm on the 22nd October 2019. This Director currently has 122,622 shares.

23 Oct: Brian May, Financial Director, sold post-exercise 7,627 shares in the firm on the 22nd October 2019 at a price of 1896p. This Director currently has 114,995 shares.

23 Oct: Frank van Zanten, CEO, exercised 11,714 shares in the firm on the 23rd October 2019. This Director currently has 109,680 shares.

23 Oct: Frank van Zanten, CEO, sold post-exercise 5,423 shares in the firm on the 23rd October 2019 at a price of 1947.68p. This Director currently has 104,257 shares.

23 Oct: Jefferies International reiterates its underperform rating on Bunzl (BNZL) and reduced the target price to 1620p (from 1700p).

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires