Aviva (AV.L) 23-04-20

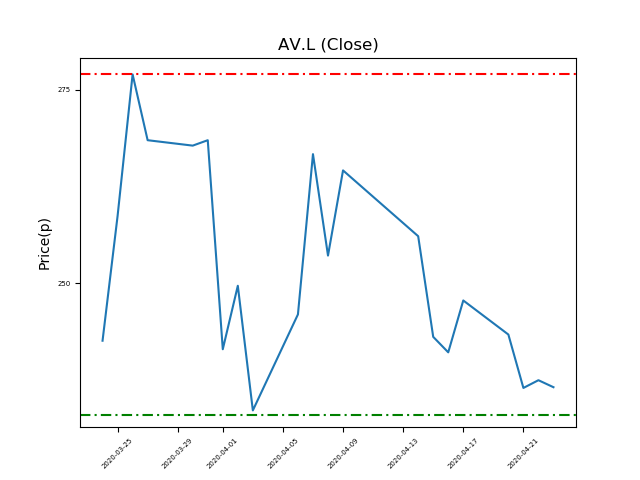

Will Aviva (AV.L) shares break below the 233p support zone, or will it return to highs of 277p (+18%)?

- Currently trading around the 233p support at 233.6p (at time of writing).

- The support has proven robust to date. Will the pattern repeat?

- The price has tested this level repeatedly. Traders should be mindful of stop-loss placement.

- Will the share price bounce once again to recent highs of 277p? (+18%).

- Technical traders should be mindful of news and developments. Check our website and the press for updates.

- Shares -46% from 12-month highs; +10% from 12 month lows.

Latest News

30 Apr: Aviva, the insurance group, announced on Monday that it planned to provide a goodwill payment to shareholders who sold preference shares between the 8th and 22nd of March.

23 Mar: Aviva backed down on plans to cancel preference shares, after criticism from many investors.

08 Mar: Aviva posted operating profit 2% higher at £3.07bn in 2017 from £3.01b the year before, which underpinned a 18% rise in dividends. Dividends per share increased by 18% to 27.4p, up from 23.3p.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires