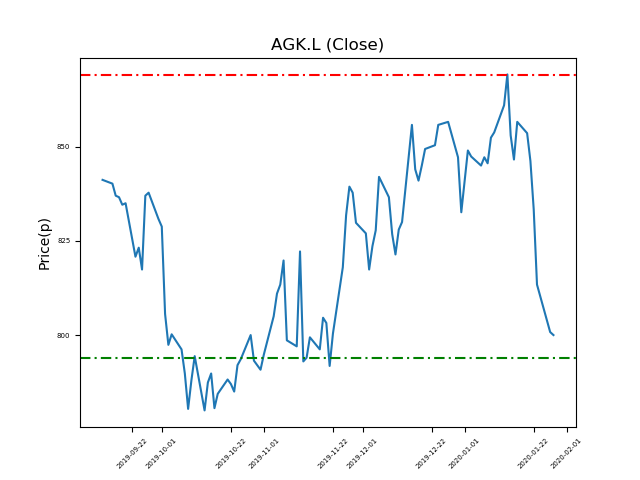

Aggreko (AGK.L) 29-01-20

Will Aggreko (AGK.L) shares break below the 794p support, or return to highs of 869p (+9%)?

- Currently close to the 794p support at 797p (at time of writing).

- This has been identified for ostensibly strong support level. Traders should consider whether they think it will hold up again.

- Will the price bounce again to recent highs at 869p? (+9%).

- Technical traders should consider potential news and developments. Check our website and the press for updates in future.

- Shares -8% from 12-month highs; +15% from 12 month lows.

Latest News

27 Jan: Berenberg reiterates its sell rating on Aggreko (AGK) and increased the target price to 650p (from 600p).

08 Jan: UBS reiterates its sell rating on Aggreko (AGK) and increased the target price to 700p (from 640p).

25 Nov: RBC Capital Markets reiterates its outperform rating on Aggreko (AGK) and reduced the target price to 960p (from 1000p).

12 Nov: Aggreko announced that revenues fell 8% within the first 3 quarters to the end of September, as softness in its power utility business unit affected trading.

05 Nov: Credit Suisse has upgraded its rating on Aggreko (AGK) to outperform (from neutral) and increased the target price to 905p (from 750p).

04 Oct: Berenberg reiterates its sell rating on Aggreko (AGK) and reduced the target price to 600p (from 770p).

03 Oct: Peter Kennerley, Executive Director, bought 41 shares within the firm on the 1st October 2019 at a price of 829.80p. This Director currently has 14,114 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires