Any driver you like, so long as it’s China

Q3 looks set to enter the records as the most volatile so far in 2015 with the UK 100 index trading in a massive 920pt range that included one 885pt August down-move – that’s 885pts worth of tradeable moves in the index in August alone!

The UK’s benchmark blue chip index has been under pressure from two drivers that are really just one: China.

The US Fed kept interest rates near zero in September, but its reasons for doing so were better digested by the markets than the simple prospect of cheap money for longer. China slowdown concerns ‘made official’ by the Federal Reserve spooked the markets big time, uncovering in the process some pretty reasonably priced stocks while giving gold a welcome boost.

Greek woes receded a little with snap elections returning Alexis Tsipras’ Syriza party to power. With the protracted debate (we’ve grown so used to) about debt relief likely to dominate for the foreseeable, we expect the market’s reaction to follow suit in a slow and steady manner. Greece can be all but brushed aside for now.

Towards the end of September, we’ve seen markets rally as buyers return to pick up some nicely discounted shares while inflation concerns look to be pushing a US rate rise further into the future as Chinese concerns abate and the Fed looks closer to home for indicators, US macro data not looking like making the case for an imminent increase in rates.

The US central bank has two more opportunities to lift interest rates this year. Will it take either? It really doesn’t matter - there will be winners, whatever happens.

Facts

A broad market sell-off in August has seen many a UK Index blue chip stock retreat from highs to trade at sometimes heavily discounted levels. The highlight of the final week of September was, of course, Glencore with its share price swings of 10 – 15% in quick succession – and it’s still not clear what the reason was as analysts and company officials each put forward their own opinions.

Such volatility in the markets means plenty of opportunity, bou it’s vital that you, the trader gets the news that matters, when it matters. It took nearly a whole week for the BBC to start covering the Glencore story. Brokers and traders at city firms like Accendo had their eyes on Glencore months ago, and so did their clients.

In addition, amid so much news and distraction concerning the US central bank and concerns about Chinese and global growth, were you aware that quite a few stocks actually did extremely well while the UK Index index was in a downtrend? If you thought Q3 was a bad one for the markets, take a look at the tables on page 1. IAG +18%, HIK +18%, TUI +18%, ABF +16%, SAB + 15%.....

These are not small gains in what many have deemed a bear market, but you won’t have read much about these companies in the papers or on the BBC. As an Accendo Client, you’d have had got the news that moved these stocks just when the professionals did: when it happened.

Accendo Markets’ ten stocks to watch for Q4 2015

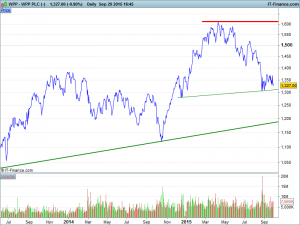

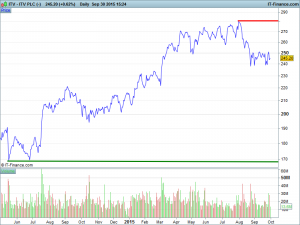

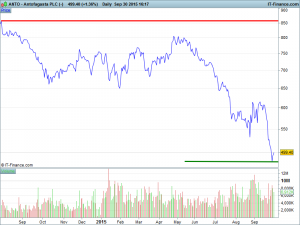

We've picked ten stocks we reckon you should be keeping an eye out for in Q4 2015. Some did well in Q3 and look like they still have momentum, while others have suffered and could be more speculative (like UK Index miner Antofagasta (ANTO)). We’ve looked for the socks we think have the most potential to both continue on their current trajectories or indeed reverse course, having potentially peaked or bottomed out.

ARM Holdings, for example, has been affected greatly by China (fears overblown?) and an Apple results-induced wobble in August (Short-term concerns?). But the company licenses its chips to almost every smart phone and tablet manufacturer in existence. Could ARM be set for a re-visit of its 2015 highs?

Direct Line Insurance is just 2.2% from its own 2015 high, is up 8% since the UK 100 commenced its downtrend in late April and has rebounded 5% from the 24 August sell-off. Is it now overvalued, overbought, or is this a bullish sign of great resilience for this stock?

Of course, market conditions may change as we move into October, which is why it’s so important to be kept up to date with news and events.

Read on for the lowdown on our Q4 stock picks.