2016 – A year of opportunity

With 2015 a notably volatile year and many a stock now trading at heavily discounted levels, we’re approaching what could be a turning point. As an investor, you’ll know just how much has been happening this year, and how much uncertainty has stalked the markets with the resultant volatility proving difficult for many to navigate. At the same time though, it’s provided the ideal trading conditions for those who have been eyeing market moving events for their short-term effects – these having been particularly prevalent in 2015. Short, sharp market moves.

The news has been the news – there’s little point in over analyzing it here, because you as an investor want to know what to look for in the coming 12-months. Let’s merely summarise, then, the prime drivers that have moved markets in 2015:

- Greece

- US interest rates

- Chinese economic slowdown (or is it?)

- Commodities

- Unrest in the Middle-East

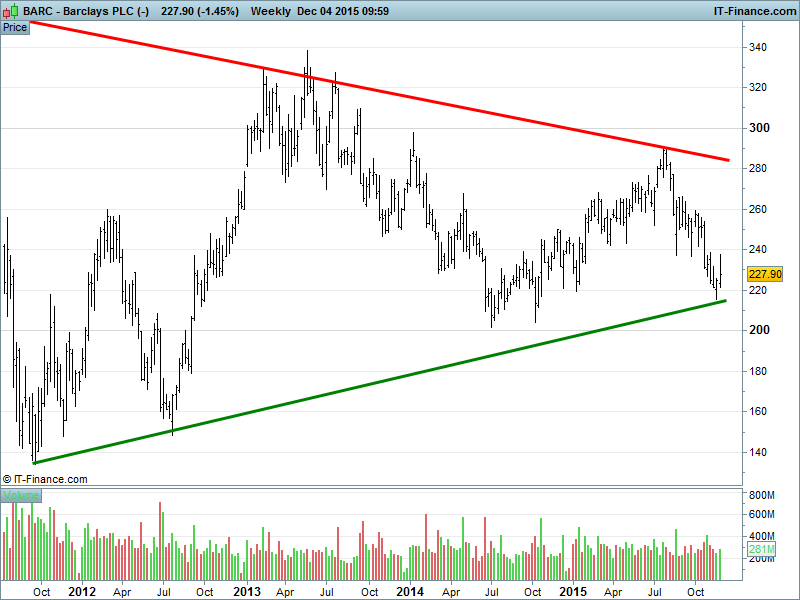

Looking forward to 2016, the question becomes: which of the above is set to continue influencing the markets? Greece is still not settled, but is easily eclipsed by the Eurozone vs. US monetary policy issue. A December move on interest rates by the Federal Reserve seems likely. Markets have all but priced it in. With higher interest rates, financials stand to benefit.