With the New Year just around the corner, it’s time for traders to begin considering what 2018 has in store.

In our last publication (Santa Rally, 5 November) we highlighted the phenomenon of window dressing by some fund managers – the process of cutting underperforming stocks in order to make portfolios appear more attractive to prospective 2018 clients.

On the other side of the card, however, is the idea that managers attempt to identify undervalued stocks at the start of the new year in order to tap into their ‘recovery potential’ and register strong returns.

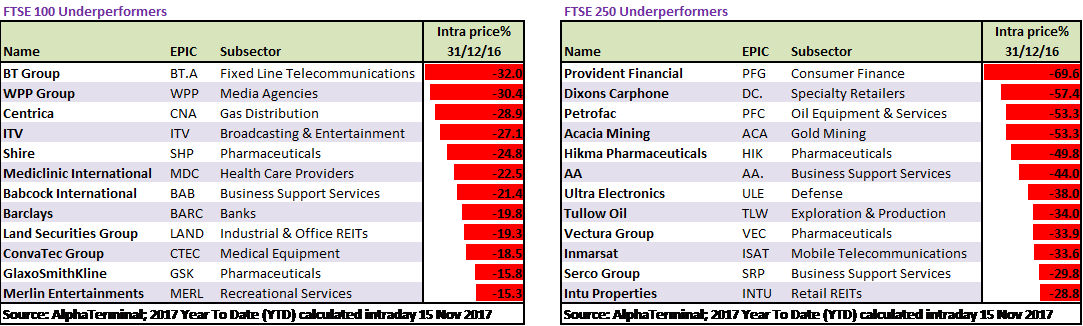

With that in mind, we’re analysing the 12 worst performing stocks on both the UK 100 and year-to-date (YTD) and assess which have the best recovery potential heading into 2018.