UK Grocery Market Prospects

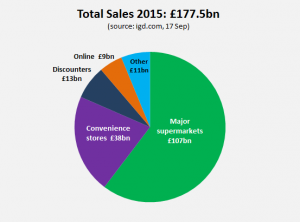

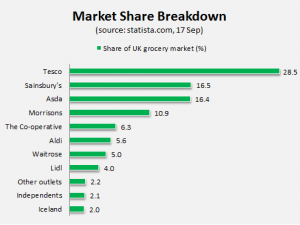

In this report we look at the UK supermarket sector and its prospects for the rest of 2015. It’s been an interesting year so far, with the big four – Tesco (TSCO), Asda, J Sainsbury (SBRY) and WM Morrison (MRW) – facing continued stiff competition from rampaging German discounters Aldi and Lidl. We’re even seeing attempts at making frozen food cool again begin to bear fruit with the likes of Iceland stepping up to the mark to maintain pressure on the bigger guns.

The UK consumer is much scrutinised as an economic barometer, but never so much as to gauge the health of the general retail sector and this makes the supermarkets some of the less cryptic stocks in the UK 100 . Drivers tend to be much closer to home – think inflation, average earnings, consumer sentiment and interest rates – even if the supermarkets have their fingers in pies much further afield.