You may be familiar with the old adage:‘Sell in May, go away, don’t come back until St. Ledger’s day.’The premise of the saying goes something like this: The summer is, some say, a tough time for stocks. They suffer across the board as people switch off their central heating, stop drinking so much tea, watch less television and top up their vitamin D, causing a drawdown in the profits of utility companies and tea producers while the retail business suffers through a lack of festive and ‘therapeutic’ spending, apparently.

To add insult to injury, so they say, many of the aforementioned consumers are also traders who, while sunning themselves and their families in the Bahamas, attending the races and generally not trading the markets, exaggerate the losses further through a distinct lack of trading volume, apparently.At Accendo Markets, we’re not sure of the last time ‘sell in May, go away’ was updated to bring it up to speed with the world as it is today. So we’ve done a little research, and you may already be realising that what we found is actually quite exciting. You know we wouldn’t be writing this exclusive report for you if it wasn’t!

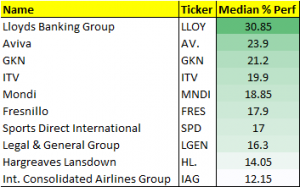

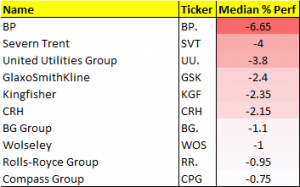

It didn’t take long to find one piece of external research that suggested those who sold their shares in May, reinvesting in mid-September every year since 1989 only won out for 10 out of 29 years. Not wanting to take this as gospel, we had a look at the hard data and have amassed a list of 10 myth-busting, trend bucking stocks. Some will be familiar, others not so, but all have the potential to do well this summer.