Santa Claus is coming to trade…

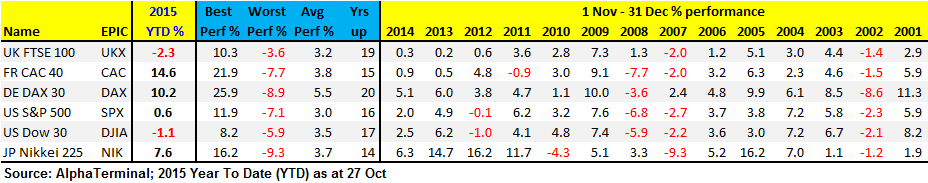

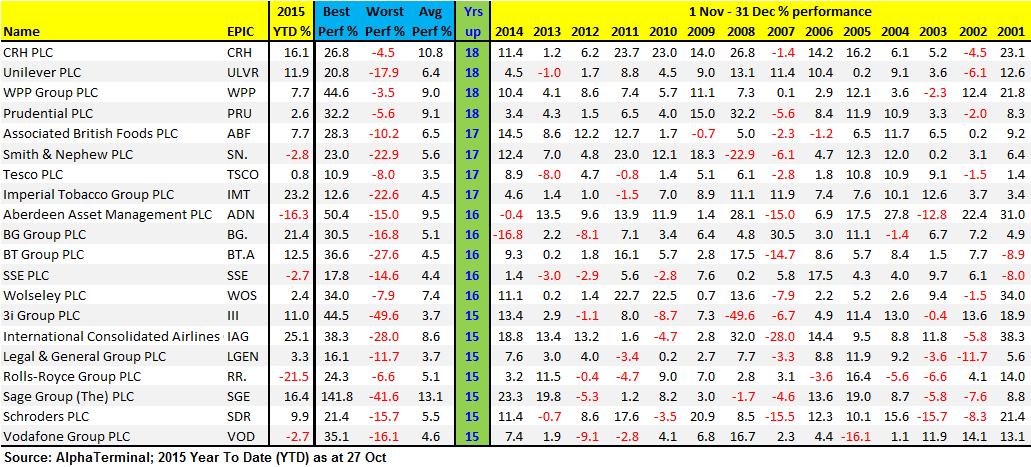

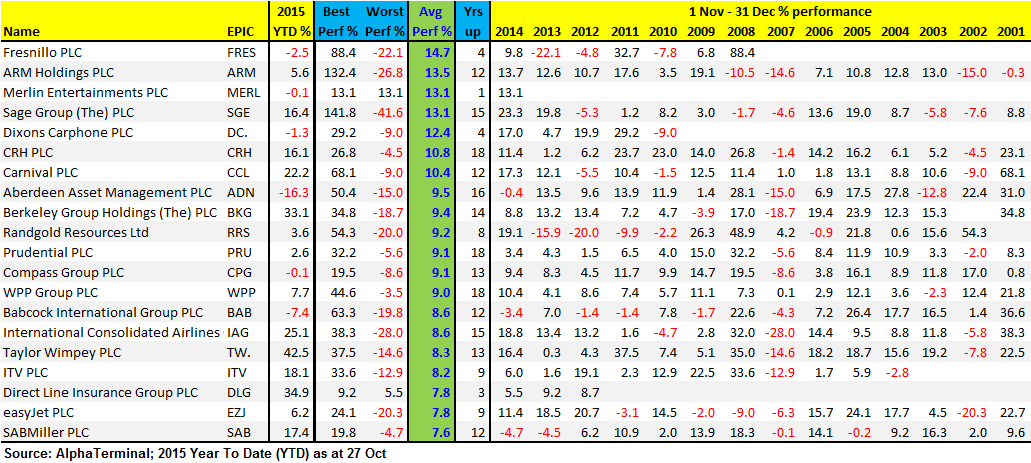

In the business world, Christmas definitely gets earlier each year. Equities have arguably already begun what the old adage hails the ‘traditional year-end gains’ or ‘Santa Rally.’ While there’s no reason to suggest it’s a given that markets always rally into year-end, certain conditions tend to prevail that provide buoyancy - namely ‘window dressing’ by fund managers who hold onto stocks that have done well in order to entice new clients for the coming calendar year. Such hoarding of in-demand stocks can often cause bigger than normal price appreciation.

Have you done your shopping for the stocks with the best potential? We normally send this report out at the end of November, but this year that’ll be too late. We have updated our data early for the second year running on account of current market conditions.