Well known phenomenon

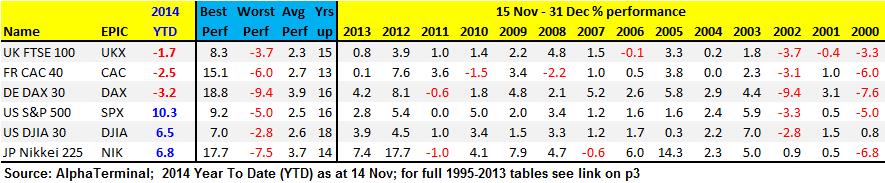

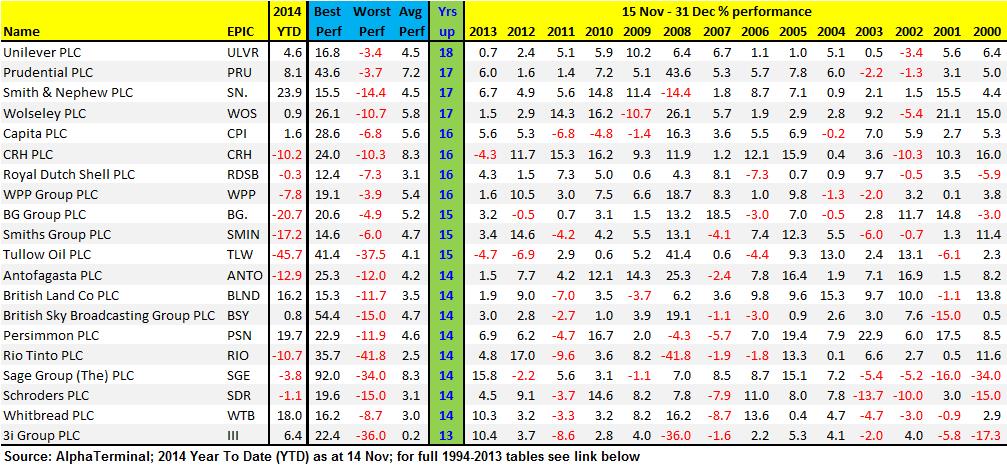

It’s not long before equities begin what the old market adage hails as traditional year-end gains or the Santa Rally. Have you done your shopping for the stocks with the best potential? Normally sent end-November, we have updated our data early on account of current market conditions and self-fulfilling nature of the phenomenon tending towards an earlier start each year. While we don’t subscribe to the view that ‘shares always rally into year-end’, fuelled by volatility thinner holiday volumes and window-dressing (fund managers wanting to hold what’s done well; illusionary), what we do know is that the UK 100 index has a strong tendency to rise from mid-November through year-end, offering short-term traders potentially profitable trading opportunities.