How to stay in the game

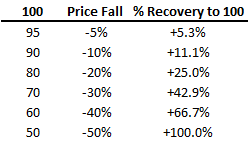

When trading it’s natural to focus on profits and profits alone. But don’t be fooled when T.V. adverts tell you that that’s what the best traders do. They don’t! If you watch the financial news channels then you may hear talk of ‘love for the game.’ If you want to stay in the game, then preservation of capital becomes more important than accumulation. After all, if you manage risk effectively, you increase the scope of opportunity to make a profit. If you don’t, well, you only have one chance to lose everything. Get good at the game, and the money will follow.

We haven’t just written this special report because the markets are volatile. The concept of protecting your capital is every bit as important as growing it. This isn’t rocket science either – risk management needn’t involve any fancy financial engineering as we’ll see. Risk can be managed both before you even enter a trade and when you’re in the thick of it.