As the fog clears, can we be expecting a positive 2016?

We’ve talked a lot about the need for a diverse range of investments and a trading strategy that includes short selling (something traditional share dealing doesn’t allow you to do). Both approaches will have helped savvy investors beat the market in 2015, and indeed in what’s been a tough start to 2016.

But plenty of traders will have made money by going Long only – don’t forget that the UK Index ’s declines could be almost all attributed to just 25% of its components since the beginning of 2015 with that small group dominated by the usual suspects: Banks, Oil & Gas and Mining companies. It’s perfectly conceivable that a well-chosen long only portfolio could have solidly outperformed the UK 100 .

What does this mean for you, the trader? It means, quite simply, that if an idea like shorting really is too alien for you to apply to your trading strategy (and there’s no shame in that), you can still make money by simply diversifying.

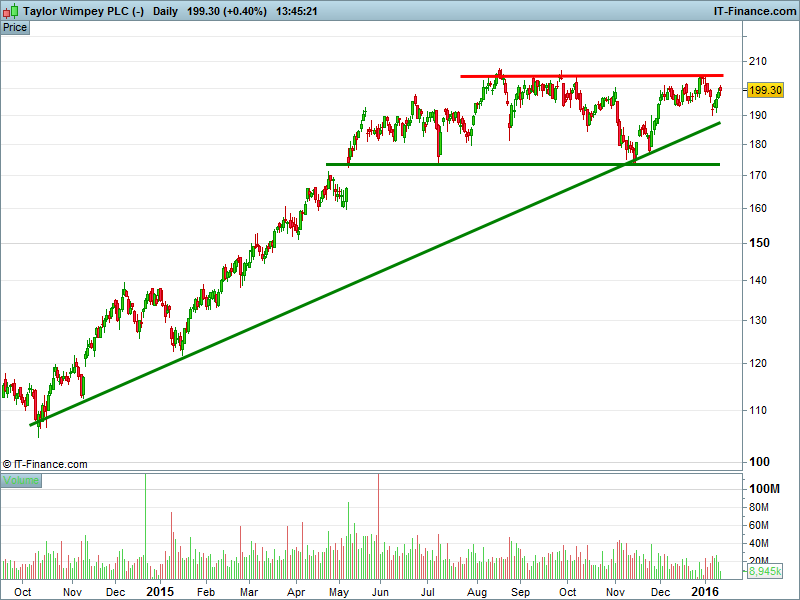

In 2015, house builders were the standout performers, rising 30 to 40% thanks to government stimulus programmes and the prospect of low UK interest rates for longer. Insurers also benefitted by 20 to 30% with generous dividend policies and solid business growth in addition to expectations of a UK rate rise in 2016 (which would increase income from short dated government bonds in which the non-life insurers invest).

Travel stocks and the airlines climbed 25-30% on low oil prices. That’s right, low commodity prices aren’t bad for everyone! Media companies rose by up to 30% and Pharmaceuticals climbed by up to 16% as M&A chat pervaded the press.

We’ve been asking the question: “What’s changed?” as an argument against going long mining and oil stocks, but the question is equally valid for the rest of the market. What if we were to look at some sectors that did well (and not so well, though we’ll ignore miners and oil stocks this time!) in 2015 and pose the same, simple question? If nothing’s changed then it’s fair to assume current trends will continue, while if it has then we should expect a resultant change in our focus area.

Nearly all media focus has been on a Chinese slowdown, falling commodity prices and the knock-on for the Oil and Mining sector because these are what weigh most heavily in the UK Index , or used to be at least. But that doesn’t mean they ARE the UK Index .

There are actually lots of positive things going on within the UK 100 right now, and plenty for the long only investor.