2017 has been challenging for many UK pharmaceutical companies; with competition to pump out the most effective, cheapest and easiest to produce drugs at an all-time high, some UK Pharmas are feeling the pressure.

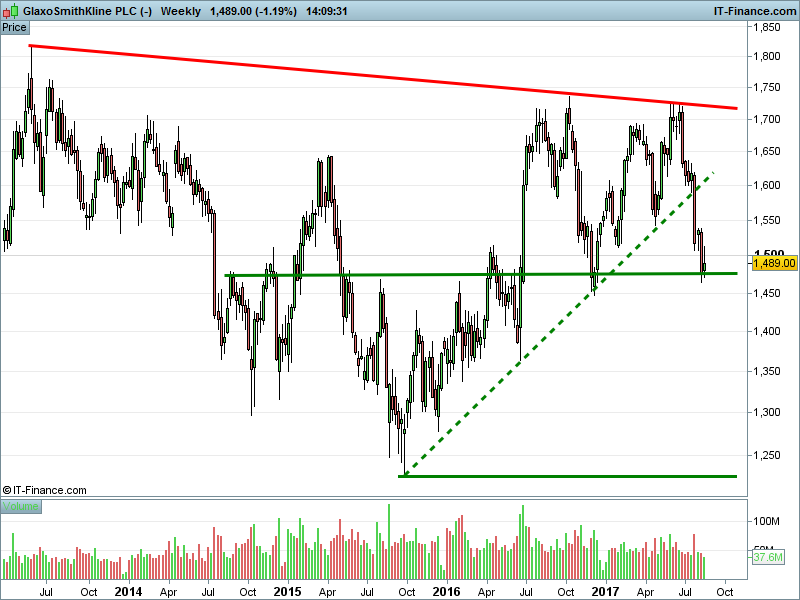

However, after tough times often comes great opportunity. This report covers the two largest UK pharmaceutical companies, AstraZeneca and GlaxoSmithKline, analysing why two of the top 10 largest global drugmakers are trading at 2017 lows, and whether there is further to fall or if now the best time to buy both stocks?

A tough pill to swallow

Over the past two months, global pharmaceutical companies have had to face the music. Donald Trump’s failure to remove Obamacare from the US healthcare system has limited their potential profits. The programme limits the companies’ ability to charge higher prices for their products as they battle to aggressively price drugs for national use. However, with the President seemingly fixated on repealing Obamacare, can Congress deliver?

In a highly globalised and competitive world, smaller pharmaceutical players from across the world have eaten into the share of their larger counterparts. The expiry of critical drug patents and drug trial failures of products that are pivotal to future pipelines have hurt both Astra and GSK. But can both turn setbacks to future success?

Highs on the horizon?

There are some convincing arguments to make against the ditching of Astra and Glaxo shares. Pharmaceutical companies have historically fared well in falling markets, benefitting from “defensive” demand. Thanks to the consistent demand from those needing medical care for the companies’ products, removing the risk of cyclical or seasonal demand patterns. But another, potentially more profitable reason to hold the shares may soon arise.

As the UK Pharmaceutical sector falls to its lowest level of 2017, talks of foreign takeover bids are rife. AstraZeneca is no stranger to fending off takeovers, most notably in its 2014 defence from US colossus Pfizer. Labelled ‘the Great Escape’, Astra defended itself from a £69.4bn offer from the States that would have created the world’s largest drugmaker. Now, however, with the share price below its 2-year average and 20% below its 2017 highs, following some major pipeline setbacks and reports that he may be taking another top job elsewhere, will CEO Pascal Soriot succumb to the allure of money from a global pharmaceutical company?

With AZN and GSK shares within 10% of their 2017 lows, do you see the sector weakness continuing into the final third of 2017? Or perhaps you think that this as the perfect opportunity to buy both stocks?

Turn the page for further analysis of each of the UK pharmaceutical giants, including which stock may be preferable for you and how to optimise your potential returns on either stock. Are you a buyer or a seller?