Not all doom ‘n’ gloom

They say a picture paints a thousand words and there is indeed nothing better than a price chart to show the many attractive opportunities 2015 presented in terms of share price moves. Have a look at a UK Index chart. It wasn’t all. A terrific journey was to be had along the way if you looked a little further and considered other options.

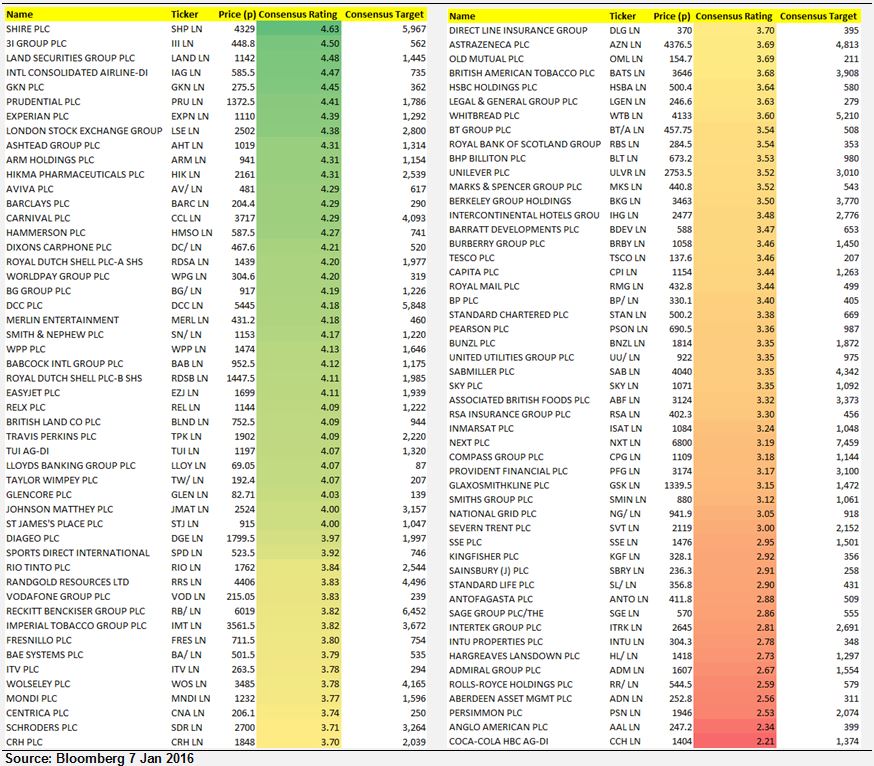

While the UK Index did indeed fall by 5%, don’t forget it is an index of 100 stocks. And one thing is for sure, they didn’t all fall 5% last year. For sure, some fell a lot more, widely talked about in myriad annual media roundups over the festive period. But what about the stocks that fared rather better, in some cases posting impressive gains of up to 45%? Who’s taking about them?