A bold move

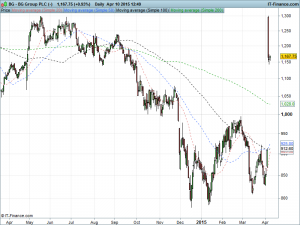

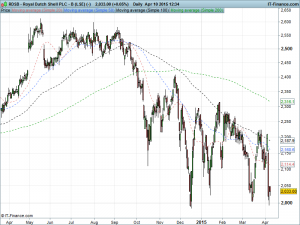

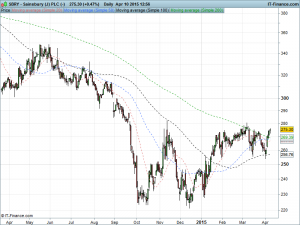

The oil and gas sector has been highlighted before for its potential for mergers and acquisitions activity as a group of resilient oil majors, able to borrow at low costs, stalk their weaker small cap prey across the globe. But with so much attention on this one sector, have investors missed opportunities elsewhere? In this exclusive report we analyse the Shell/BG deal and present some additional interesting leads in other major sectors: Big Pharma, Tech, Telecoms & Media and Retail. Read on to see what we found!