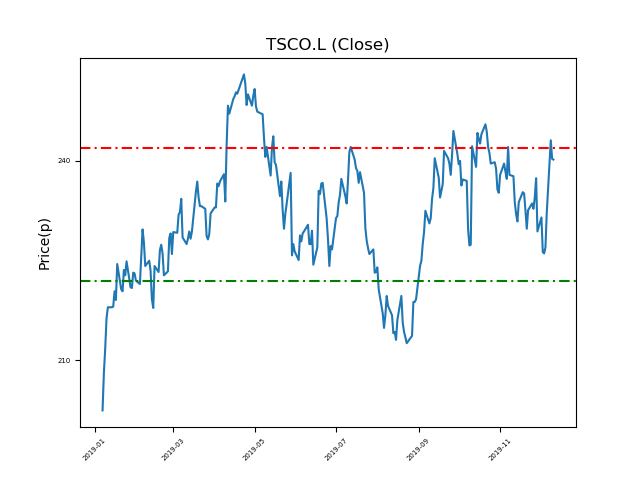

Tesco PLC (TSCO.L) 11-12-19

Will Tesco PLC (TSCO.L) shares break out of the range this time, or will it continue to fall to the 222p support?(-7%)

- Currently trading near the resistance at 242p. Currently at 239.48p (at time of writing).

- Will the range repeat itself, and is this one for the short sellers?

- The stock has tested this price repeatedly. Whilst this is likely to be appealing to traders, ranges never last forever. Take precautions accordingly.

- Will the shares fall to the lower end of the range at 222p? (-7%).

- Technical traders should be mindful of news and developments. Check our website and the press for updates.

- Shares -5% from 12-month highs; +26% from 12 month lows.

Latest News

09 Dec: Jefferies International reiterates its buy rating on Tesco (TSCO) and increased the target price to 310p (from 285p).

09 Dec: Tesco announced that it was considering disposing of its operations in Thailand and Malaysia after receiving interest in the businesses from a third party.

29 Nov: Goldman Sachs reiterates its buy rating on Tesco (TSCO) and increased the target price to 280p (from 276p).

04 Nov: David Lewis, CEO, bought 58 shares in the firm on the 1st November 2019 at a price of 237.52p. This Director currently has 170,722 shares.

Source: Bloomberg, Reuters, Alpha Terminal, FT, DJ Newswires