Pennon Group PLC (PNN.L) A trading opportunity for you?

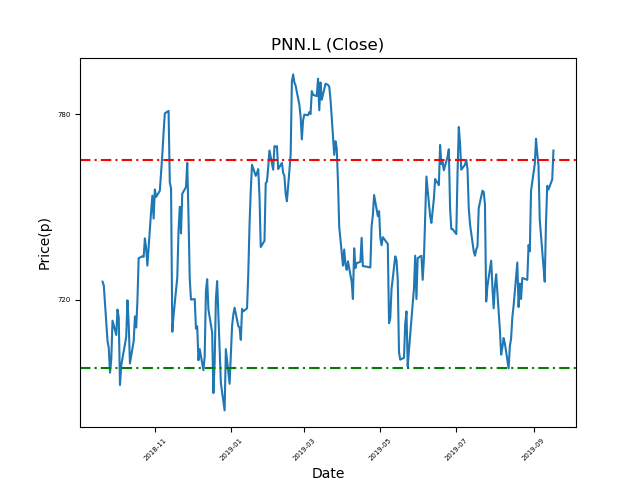

Will Pennon Group PLC (PNN.L) break resistance at 766p, or retest the bottom of the range at 702p? (-8.4%)

- Defensive utility stock.

- The range has developed over the last year.

- It has touched the 766p level multiple times in the last 12 months. It is now at 766p.

- 702p-766p trading range since June this year

- Will the pattern repeat itself, appealing to the short seller and range traders?

Source: Bloomberg, FT, Reuters, DJ Newswires, AlphaTerminal